Transforming Food – Providing The Next-Gen Food

10 June 2020

Overview

Profitability

Bio- and digital-technology developments are making it increasingly feasible from both a technical and economical standpoint to provide sustainable alternative foods. The key issue for large scale adoption remains cost – improvements aim for cost parity, or for justifiable premiums.

- The currently viable alternative foods already on the market are able to compete on price as well as taste, sustainability and healthiness.

- Dietary requirements and consumer habits remain strong drivers for food demand growth.

Environmental impact

Alternative foods require significantly lower amount of water to be produced, notably for alternative proteins (meat substitutes) and dairy products. Also, by reducing the need for livestock, they help reduce related externalities (animal waste, cruelty, etc.) and freeing up agricultural products currently used to feed animals

- Globally, ~70% of soya, and about 50% of grains, are used to feed livestock

- Livestock compete with human for carbohydrates and proteins sources.

Health impact

The use of advanced biotech tools in food prevents contracting meat-born illnesses and food allergies while increasing nutrient content as well as avoiding use of antibiot - ics and chemical substances. Nevertheless, as with most novel technologies, there is still not enough “history” and testing to provide widespread safety reassurance.

- Regulators are very restrictive on allowing technologies.

- Public remains skeptical on highly transformed foods despite its sustainability.

Genetics – The Tech

Selective breeding: (un)natural selection

Humans have genetically modified plants and animals for thousands of years. Through ''selective breeding‘’, crops and animals were selected for reproduction according to their beneficial traits. Selective breeding is still used today.

- Modern corn originated as a wild grass called teosinte that had very small ears and few kernels.

- Selective breeding has generated bananas with smaller seeds and better taste.

Mutation breeding: accelerating selective breeding

In 1920, scientists began to expose seeds to chemicals and radiation (gamma rays, thermal neutrons, X-rays) to generate random genetic mutations at a faster rate to find new useful traits. The process is known as ‘’mutagenesis’’ or ‘’mutation breeding’’ and is still widely used.

- In 1991, after 20 years of experiments, a new variety of Japanese’s pear crop, resistant to black spot disease, was created.

- Red grapefruits and other 3,000 crop varieties, are the results of mutagenesis and have been sold for decades without any label.

Recombinant DNA technology: first-generation of GMOs

In 1987, scientists started to develop a method to cut a gene from one organism and paste it into another, called ‘’recombinant DNA technology’’. Cisgenic refers to an inserted gene coming from the same species, else it is referred to as Transgenic. GMOs are organisms whose genetic material has been modified in a way that does not occur naturally and are strictly regulated.

- The first GMO vegetable was launched in 1994 (Flavr Savr Tomato) and the first GMO animal was approved in 2015 (AquAdvantage salmon).

- According to several published biotech studies, GMO technology adoption reduces chemical pesticide use by 37%, increases crop yields by 22%, and increased farmer profits by 68%.

Gene editing tools: next generation of GMOs

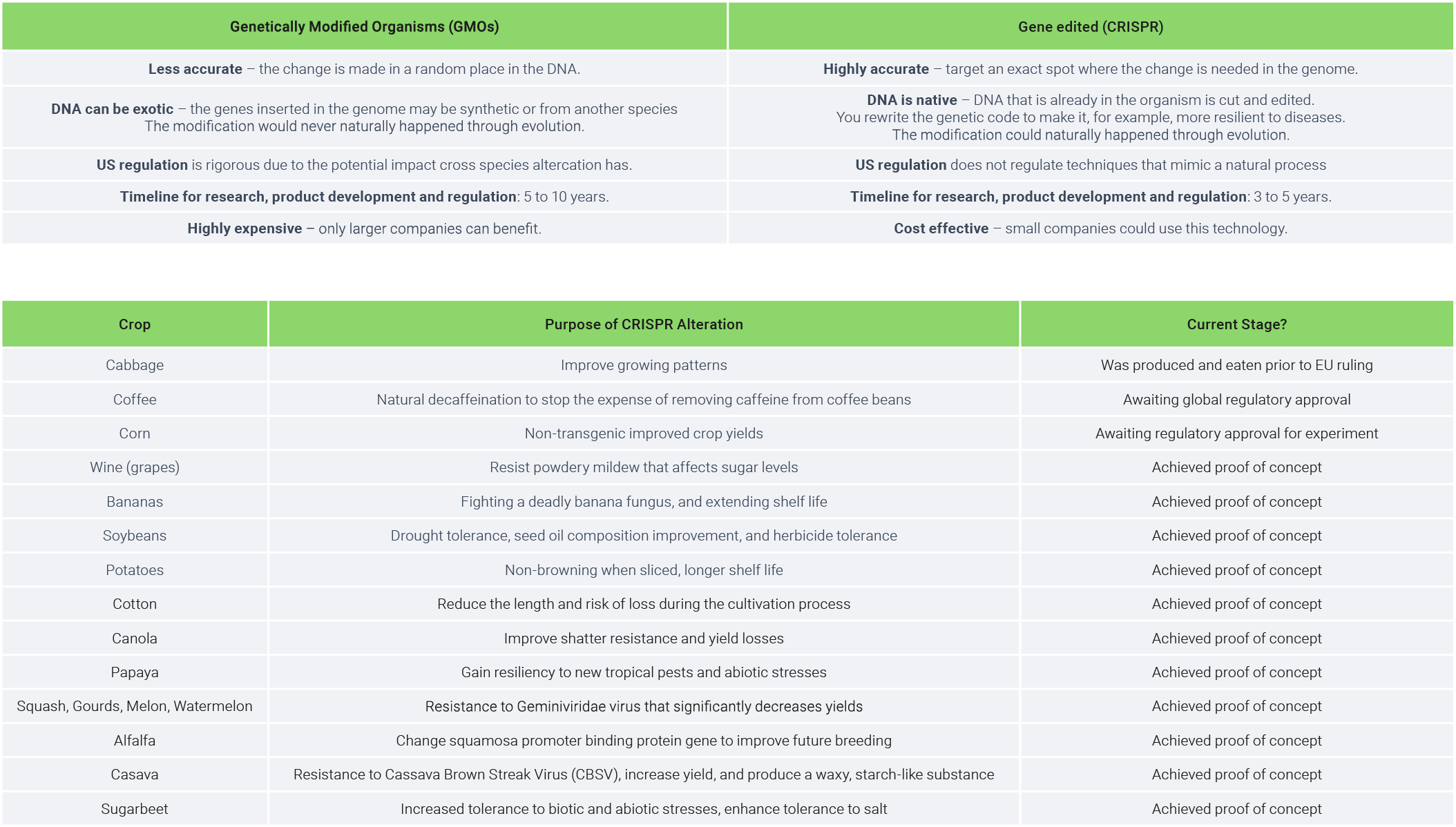

Recently developed gene editing tools allow to place the genetic change in a precise spot inside the DNA without requiring foreign DNA. With previous methods genes were inserted at a random place in the genome.

- Gene editing reduces the time to research and develop a new seed variety to 3-5 years, (vs. 5-10 years fot conventional GMOs).

- In 2018, the U.S. distinguished GMOs from gene edited food, because the latter imitates the natural process. But the EU decided that gene-edited crops are considered GMOs

Various technologies

Three tools, Cluster Regularly Interspaced Short Palindromic Repeats (CRISPR) Cas-9 (2013), Transcription Activator-Like Effectors (TALENs) (2011), and Zinc Finger Nucleases (ZFNs) (2003), are currently used for the agricultural market.

- CRISPR is so far the cheapest, most efficient and easiest to use, as Cas9 does not need to be modified at the protein level to recognize a specific DNA sequence. TALEN and ZFNs are technically challenging and time consuming.

- However, CRISPR is less specific than TALEN and ZFNs and it may experience mismatches with unwanted target locations in the genome.

CRISPR Cas 9 and TALEN foods

Several gene edited foods are currently being developed, with some already approaching the market. These improve agricultural productivity, environmental resistance (thus reducing the use of chemicals) and eliminate some allergenic ingredients.

- Tomatoes designed via CRISPR with higher vitamin C levels and disease resistance are ready for market launch, while non-browning mushrooms are waiting for FDA approval.

- Calyxt’s soybean oil has been the first gene edited food available. The soybean genome was designed using TALEN to improve the levels of oleic acids (contributing to good cholesterol).

GMOs vs. Gene Edited Food: A Quick Comparison

Genetics – The Impact

Comparative benefits

The use of gene editing tools in food could prevent the risk of food allergies while increasing nutrient composition. Besides, they reduce the use of antibiotics, pesticides, and chemical substances. For GMOs, no negative health effect on humans has been demonstrated.

- Through CRISPR, the time and cost of breeding process as well as the risk of losses is reduced.

Challenges

Most gene editing food will be subject to strict regulation, and authorizations may be difficult to obtain, as similarly, most genetically modified foods are strictly regulated, and only a few have been approved. As the most advanced gene editing technologies do not contain foreign DNA and are more specific, they should not be regulated in the same way as GMOs.

- Regulatory risk adds to the cost of development, making gene edited food still expensive compared to more conventional alternatives.

Market potential

The agricultural biotechnology market (gene editing, GMOs, crop protections (including biopesticides/stimulants) is expected to grow from $33.8bn to $56.7bn by 2024, at a CAGR of 10.9% over this period.

- • The plant breeding and gene editing segment is expected to grow the most at a CAGR of 20%, from $7.5bn in 2018 to $14.5bn in 2023.

Cellular Agriculture – The Tech

Cellular agriculture: welcome the food of the future

Cellular agriculture focuses on the production of animal products, such as milk, eggs, and meat from cell cultures in laboratory. Using a combination of biotechnology, tissue engineering, and synthetic biology, the resulting food is exactly the same as produced from animals and plants.

- Acellular agriculture, also called “fermentation-based cellular agriculture” uses a microbe like yeast or bacteria to produce animal products like milk or eggs.

- Cellular agriculture refers to growing agriculture products that are based on living cells, such as meat.

Acellular agriculture: the new era of animal-free dairy products

Acellular animal products are made using microbes (such as yeasts or bacteria). Microbes are genetically modified to carry on the genetic instructions to produce the desired protein. The host organism is then grown in large quantities under controlled conditions in a bioreactor, a big steel tank filled with a nutrient medium.

- In 1990 the FDA approved a genetically modified bacteria that produced rennet, the enzyme used to make cheese. Cell-cultured rennet is purer and less expensive than animal-harvested rennet.

- On 2019, Perfect Day released its ice cream made from non-animal whey protein.

Acellular agriculture: how synthetic biology is impacting the food industry

With DNA synthesis the desired gene is identified from a sequence database and a piece of DNA is chemically synthetized to be introduced into the host’s genome. With this technique foods are re-designed and enhanced by stripping unwanted compounds.

- For exemple, Ginko Bioworks designs custom microbes for customers across multiple industries, using synthetic DNA supplied by Twist Bioscience. Motif Ingredients leverages Ginko’s technology to create novel solutions for food, like cow-free milk with no lactose.

Tissue engineering applied to food

Lab-grown meat is the most well-known cellular agriculture product. Based on tissue engineering, an innovative field focused on growing functional organs for people in laboratory, it requires to take a small sample of animal tissue, isolate stem cells and put them in a bioreactor

- The bioreactor is the chamber that houses the scaffold (a structural support to grow on) and the cell-culture serum (nutrient growth substances for cells)

- The first large-scale bioreactor for cellular agriculture could be ready during 2020.

Production challenges

Stem cells have the special ability to replicate generating two cell types: one that is the exact copy of itself and the other that becomes a different cell type via differentiation. The main technological challenge is to find the right chemical cues in the serum and mechanical stimulation to differentiate stem cells into muscle cells.

- In 2017, Memphis Meat has been successfully produced muscle fibers from stem cells.

- The cell-culture serum, which is very expensive and obtained from animal blood, is a factor limiting large-scale production.

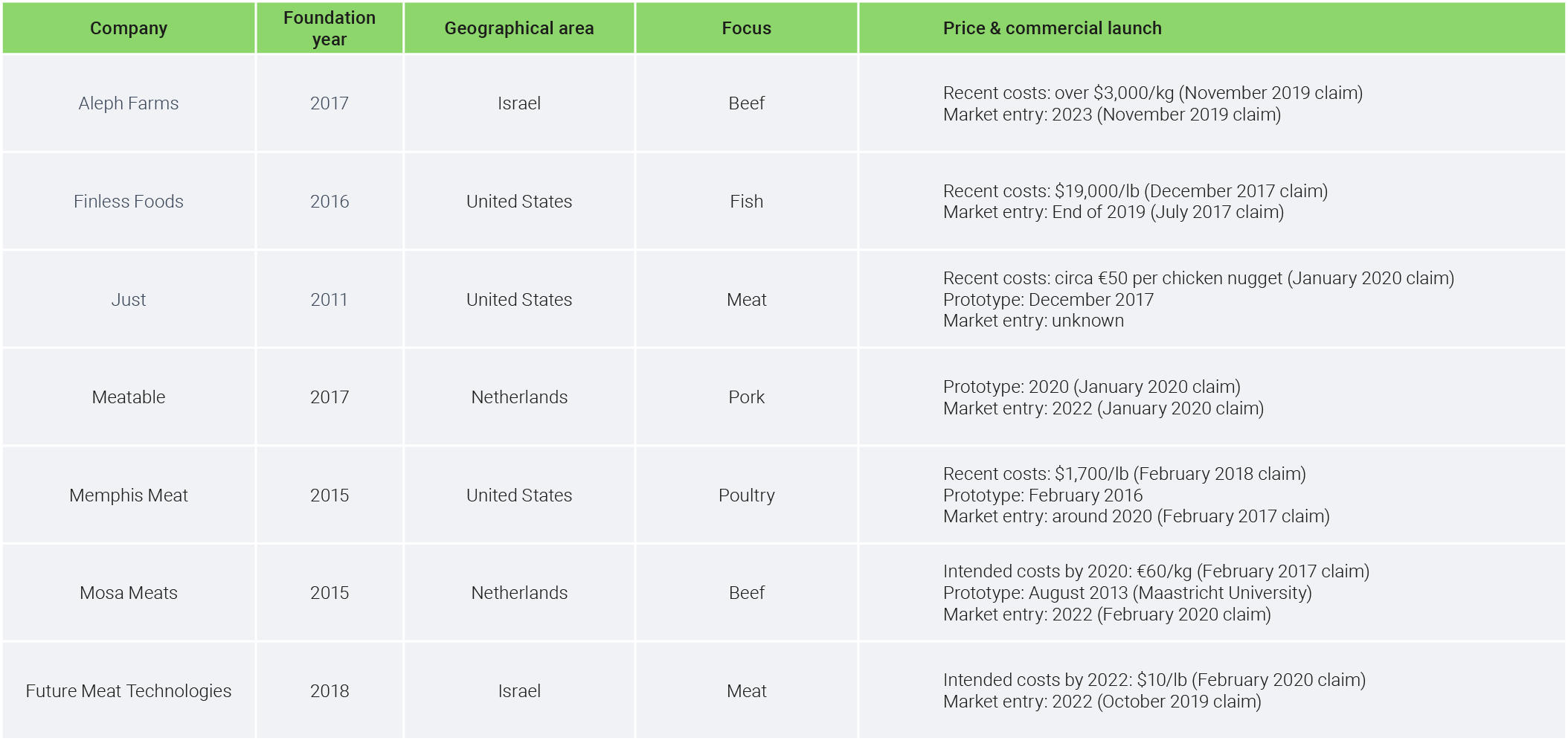

Lab-grown meat: the in-vitro hamburger soon on your plate

No cultured meat is commercially available yet. A number of projects are ongoing for fish and poultry, but so far, beef is the most advanced cell-cultured meat. Companies are working to create the best looking and tasting product while pulling down the production costs.

- The first prototype of a lab-grown burger was eaten in 2013, and it cost $325k.

- Mosa Meat expects to bring cultured meat to the market by 2022 at a price <10$/lb.

Cellular Agriculture : The Pricy In-Vitro Hamburger

Cellular Agriculture – The Impact

Comparative benefits

The use of advanced biotech tools in food could prevent the risk of contracting meatborn illnesses and food allergies while increasing nutrient composition. Besides, they reduce the use of antibiotics, and other chemical substances. Cultured meats could be produced in urban factories, reducing the environmental impact of global supply chains such as transport and cellular agriculture requires no animal cruelty

- Growing meat in labs could reduce greenhouse gas emissions by 90%, lower land use by 99%, and decrease water and energy consumption as well.

Challenges

New advanced biotech technologies to make food are still expensive compared to more conventional alternatives. Even if costs are coming down fast, wider adoption is needed to ensure the economies of scale that would make the production process price competitive.

- A major challenge for the nascent cultured meat industry is the ability to scale-up, as some key components (like the serum to grow cells) are still expensive and difficult to obtain.

Market potential

The global cultured meat market is expected to show very attractive growth rates, with a CAGR of 15% between 2020 and 2025, going from $200mn to $570mn. But it still remains a tiny niche market, especially when compared to the overall global meat market.

- Today the animal meat represents a $1.2tn addressable market.

- By 2050, worldwide meat consumption is projected to increase by >70%.

Alternative Proteins – The Tech

From simple to complex alternatives

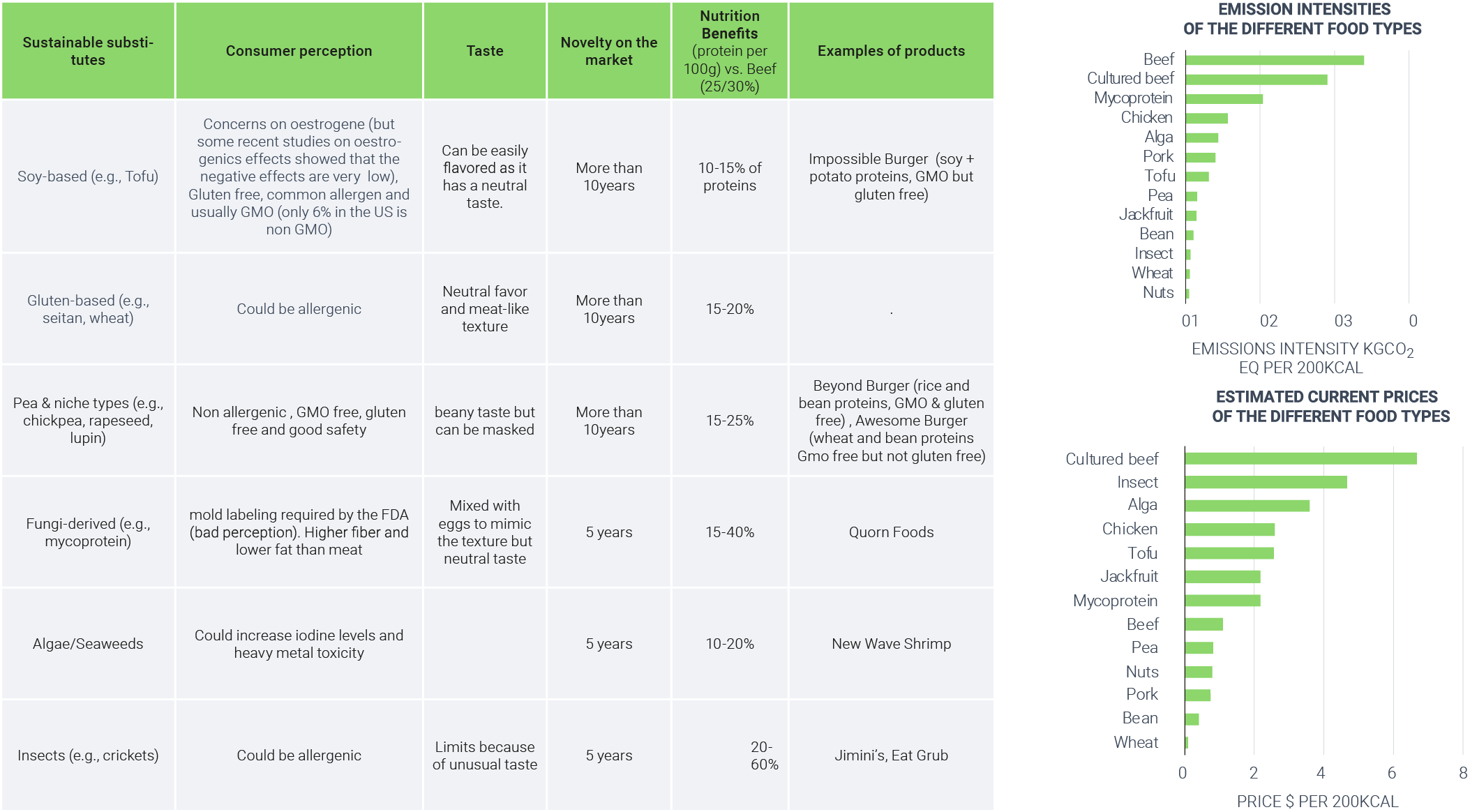

Today, consumers have many options for sustainable alternatives to animal proteins, ranging from raw to more processed products based on type of source: plants, insects, algae or mycoproteins.

- Raw products give the consumer a feeling of natural. However, meat-analogues or “fake-meat” can more easily penetrate the existing meat market than conventional veggie products.

- Environmental impact, taste, safety, animal welfare, price and nutrition benefits offer opportunities but also challenges.

The secret: raw ingredients selection

Regardless of the way of consumption (natural or processed foods), the selection of alternative protein types have both a nutritional and taste impact.

- Proteins are vital for all the functions of our body. They are made up of blocks of amino acids, 11 of which are created by us, but the 9 essential ones must come from the food.

- Not all sources are equal, as in addition to proteins we eat everything that comes with them, the good and the bad (fats, fibers, vitamins, sodium, etc.).

The best sources of vegetable proteins

Quinoa, wheat and soybeans are the only plant-based food that are “complete” pro - teins, meaning they contain the 9 essential amino acids. Plant-based proteins have the advantage of taste and are essential in the extrusion process to reproduce the fibrous texture.

- Beans are incomplete proteins but provide more fibers

- Seaweeds absorb a significant amount of carbon from ocean water and supply a range of micro-nutrients and vitamins/ minerals. Its oil is rich of Omega-3 fatty acids, with a level of DHA equivalent to salmon-based oil.

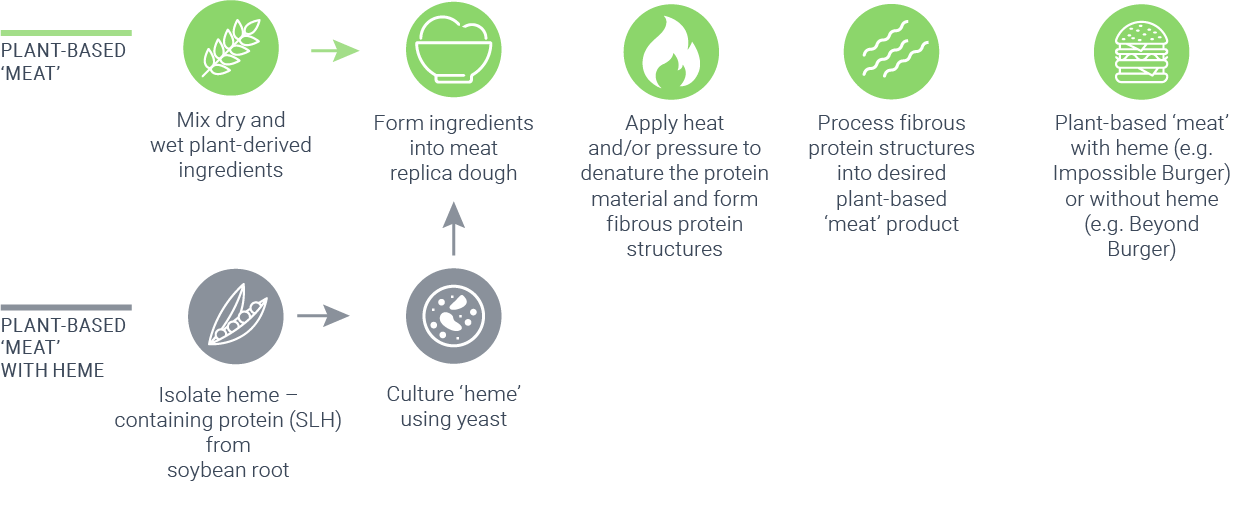

Meat-Analogue – Transformation Process

Next-generation of veggie burgers: meat-analogues

Meat-analogues try to replicate the texture, look and taste of real meat from plantsourced proteins using a processing technology called twin-screw extrusion. At a molecular level, at least two sources of plant proteins (usually peas, soybeans) are extracted, isolated and transformed into a flour that is then mixed with a binding agent (methylcellulose), minerals/vitamins, liquids, and oil inside an extrude machine to create a dough. A final cooling die gives the fibrous texture

- Time, pressure, temperature and design of cooling channels are the essential and secret parameters; the exact “recipe” and how ingredients interact remain opaque.

Fake bloody texture is the key

The extrusion process is used by almost every producers however the difference remains on the ability to reproduce the bloody appearance at the heart of the meat.

- The “bloody” aspect and taste of the Impossible Foods burger come from cultured heme. Soybean is used to produce the leghemoglobin.

- The process is expensive and with limited capacity. Despite the price they enjoy significant commercial success.

Insect is the new beef

In recent years, non-vegetal meat substitutes have emerged, notably insects. Besides being a great source of protein, these substitutes contain all essential amino acids, a high percentage of calcium, vitamins, omegas, and low level of fat. Nutritionally, insects are better than meat, and require low consumption of resources.

- Insects are the most diverse species, with more than one million types described and more than 1,400 species of edible insects currently eaten by humans.

- Insects could provide the calories needed for human nutrition and solve the problems of famine as their calorific value is 60% and 70% higher than beef and fish, respectively.

- Production process is relatively easy, as it consists of harvesting, inactivating the microbial on the insect, a heat treatment (to kill enterobacteria) and finally drying.

The Jungle Of Alternative Proteins: Which One To Choose?

Alternative Proteins – The Impact

Comparative benefits

Fake meats are not always healthier: calories, percentages of fat and sodium are equivalent to a real meat burger. However, they contain more fiber, less saturated fat and zero cholesterol. Insects are more environmentally friendly because they produce less methane and consume less water. Improving the food supply for a more urban population will be crucial in the coming years.

- A meat-analogue burger uses almost 100% less water, 50% less energy, and is responsible for 89% less greenhouse gas emissions compared to a ¼ pound of beef.

- Insect farms have the capacity to produce on a large scale and at low cost.

Challenges

Consumers may prefer raw products, vegetables or meat, because they don’t want to eat what they consider ultra-transformed products and as safety of some ingredients has not been proven. Also, some raw products, such as insects or algae, have still a “looks” and taste limits.

- Soy or ”heme” protein which is an engineered soy protein are still looked at with suspicion from a safety point of view.

- Fungi-derived protein (mycoprotein) produced through fermentation has a mold labelling from the FDA leading to a bad perception of safety.

Market potential

Plant based proteins (the main source of alternative protein) consumption increased by 17% in 2018. This market only represents $12bn over a global meat market of $1.2tr but it is expected to continue to grow to reach $28bn by 2025.

- Plant based proteins are expected to make one third of the global market by 2054.

- The edible insect market is expected to reach $522mn by 2023, at a CAGR of 42%.

3D Food Printers – The Tech

3D food printing: dinner is printed!

3D food printing is the manufacture of food using additive manufacturing techniques (layer by layer printing). Most common is extrusion-based printing, where ingredients with a pasty consistency (e.g. melted chocolate) and low viscosity are extruded and printed through a nozzle at constant pressure. The result is a raw paste that must then be baked.

- Binder jetting uses ingredients in powder form and a liquid binder is added to each layer of powder at a fixed temperature.

- Inkjet printing projects small edible droplets onto the surface bed, and is usually used only for final decoration.

Personalize what you eat

3D food printers allow consumers to personalize food with selected ingredients based on personal preferences and nutritional needs. But 3D printed food can be very useful in specific fields such as healthcare and space travel.

- Astronauts have specific dietary requirements and food must meet a certain number of constraints to be fit for space, notably in terms of volume. The NASA Advanced Food Program, together with BeeHex, developed the Chef3D, able to 3D-print pizzas.

Already printable

The most advanced 3D food printers allow users to remotely design their food on their computers or phones and have already been used to print pasta, chocolate, sugar and vegetable mixes, including alternative proteins.

- Choc Edge was the first commercially available 3D chocolate printer (2012)

- In 2013, an in-vitro meat was printed for the first time using a bioprinter.

- In 2018, Novameat printed the first meat-free steak made from vegetables that mimics meat texture.

3D Food Printers – Already On The Market

3D Food Printers – The Impact

Comparative benefits

Consumers and producers would be able to customize their food based on their diet (vegan, gluten-free), allergies or the nutrient content of the ingredients. This would ultimately save time and could be an effective technique for mass customization.

- Spinach can be made in the form of small dinosaurs, and children will it find way more attractive to eat. Insects, which are a great source of proteins at low cost, can be designed to have a more attractive shape.

Challenges

3D food printing is a relatively new technique and there still are constraints in terms of ingredients consistency and the need for separately cooking after printing. A powdery or pasty consistency is required, and the structure may undergo a change after deposition. Companies are working to make the 3D printer an everyday food processor, with the aim of including lasers to directly cook food during printing.

- Price ranges are still high, going from 1’500$ to 6'000$.

Market potential

Thanks to a rising demand for personalized food, the global 3D Food Printing Market is projected to grow at a CAGR of 32% between 2019 and 2025

- The market was valued $91mn in 2019 and is expected to reach $484mn by 2025.

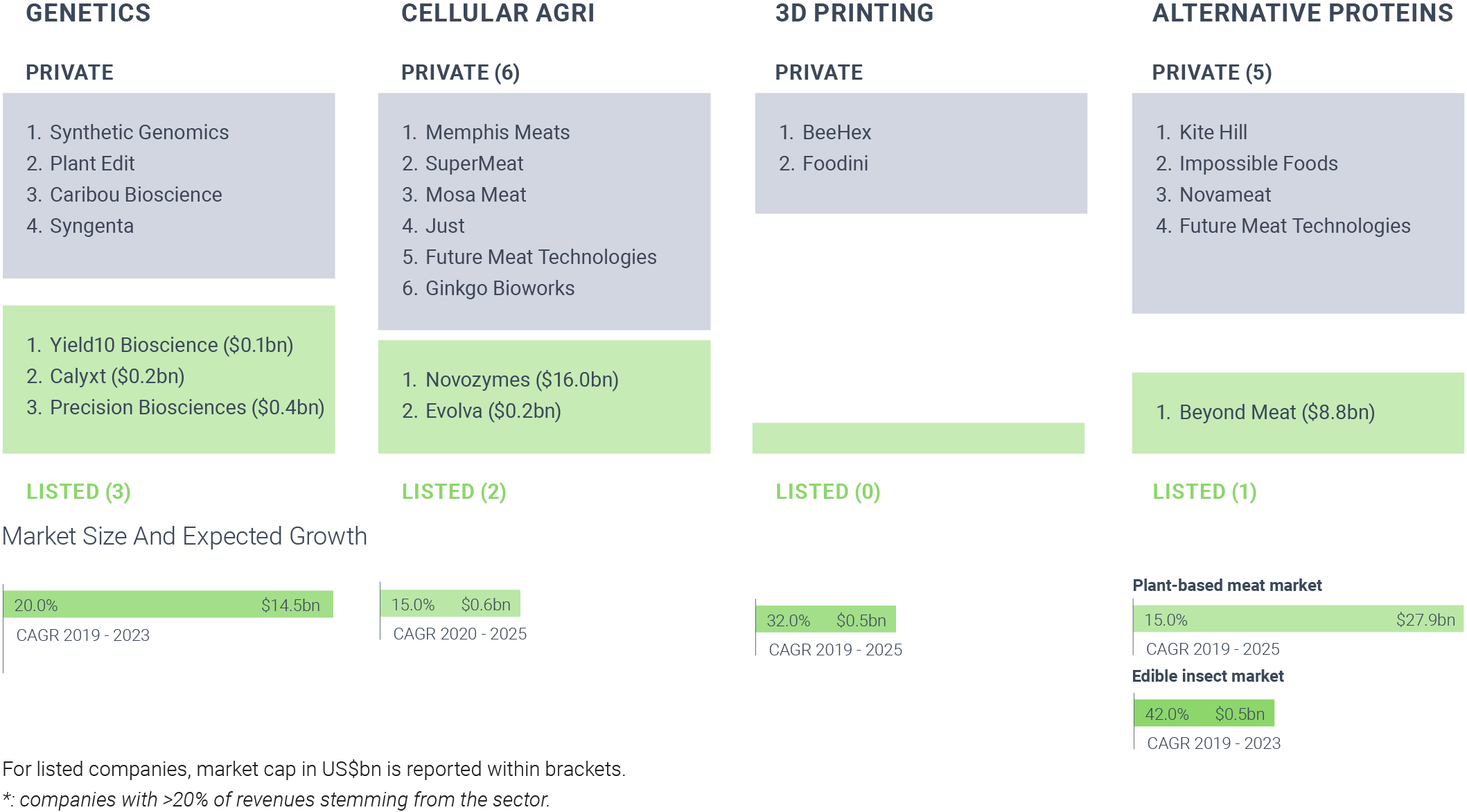

Players – List Of Relevant Pure* Players In The Industries

Sources:

Livestock - a driving force for food security and sustainable development, MarketsandMarkets; Globalnewswire, World Livestock 2011, (Food and Agriculture Organization of the United Nations (FAO), Cellular agriculture:An extension of common production methods for food, MarketsandMarkets; Globalnewswire, World Livestock 2011 (Food and Agriculture Organization of the United Nations (FAO), MarketsandMarkets, Mordorintelligence.com, researchsandmarkets

Explore:

Disclaimer

This report has been produced by the organizational unit responsible for investment research (Research unit) of atonra Partners and sent to you by the company sales representatives.

As an internationally active company, atonra Partners SA may be subject to a number of provisions in drawing up and distributing its investment research documents. These regulations include the Directives on the Independence of Financial Research issued by the Swiss Bankers Association. Although atonra Partners SA believes that the information provided in this document is based on reliable sources, it cannot assume responsibility for the quality, correctness, timeliness or completeness of the information contained in this report.

The information contained in these publications is exclusively intended for a client base consisting of professionals or qualified investors. It is sent to you by way of information and cannot be divulged to a third party without the prior consent of atonra Partners. While all reasonable effort has been made to ensure that the information contained is not untrue or misleading at the time of publication, no representation is made as to its accuracy or completeness and it should not be relied upon as such.

Past performance is not indicative or a guarantee of future results. Investment losses may occur, and investors could lose some or all of their investment. Any indices cited herein are provided only as examples of general market performance and no index is directly comparable to the past or future performance of the Certificate.

It should not be assumed that the Certificate will invest in any specific securities that comprise any index, nor should it be understood to mean that there is a correlation between the Certificate’s returns and any index returns.

Any material provided to you is intended only for discussion purposes and is not intended as an offer or solicitation with respect to the purchase or sale of any security and should not be relied upon by you in evaluating the merits of investing inany securities.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)