Investment Approach

We are, at the core, an investment research company, building strong investment convictions and implementing them in concentrated, growth-oriented thematic portfolios.

Conviction-driven

Through of thorough research and our strong convictions, our investors participate in the significant upside potential of our thematics.

atonra products display low correlations with many financial products, allowing our clients' portfolios to be truly diversified.

Fundamental, scientific, and industrial research is at the core of our DNA

Our investment process explained

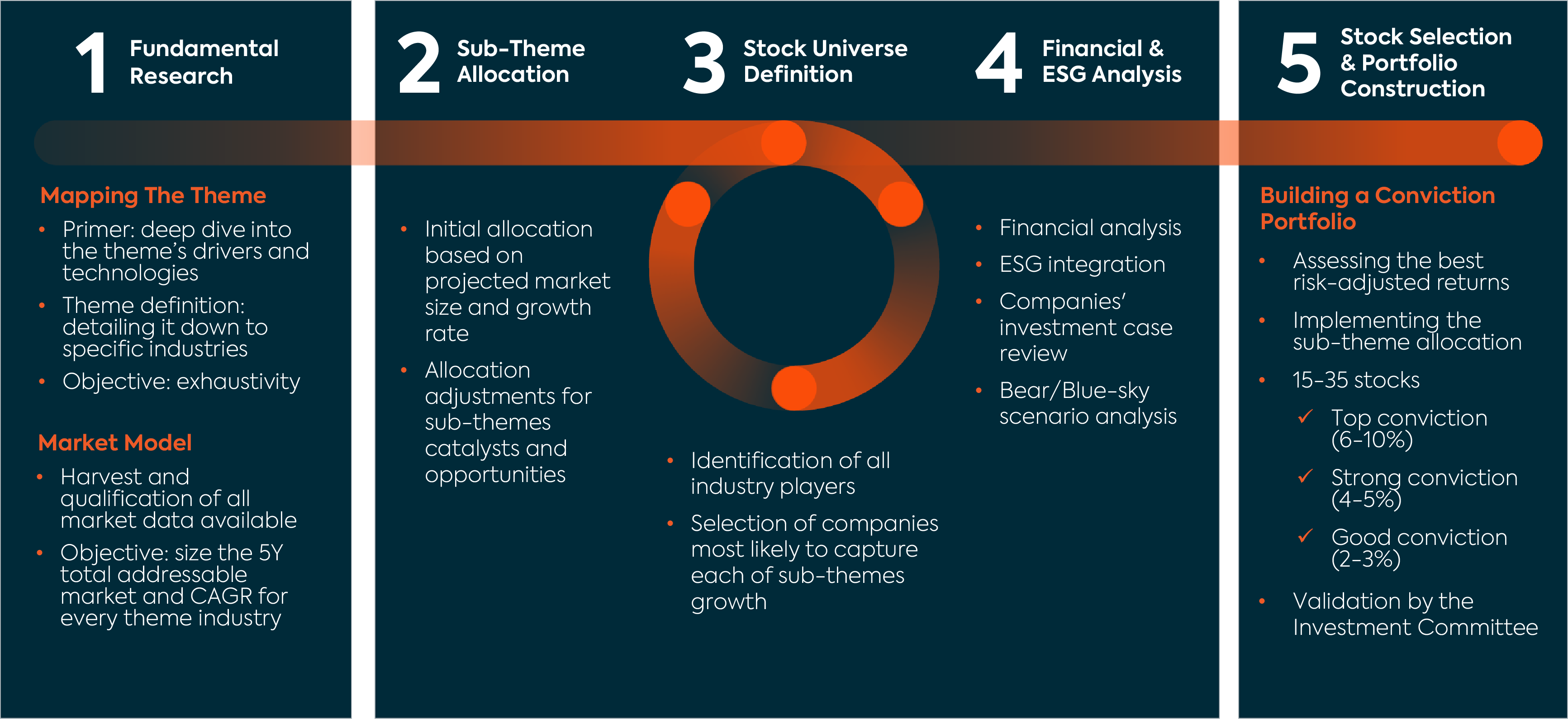

We follow five investment steps that allow us to build well-researched, growth-oriented thematic portfolios.

Fundamental

Research

Mapping The Theme

- Deep dive into the Theme (Research Primers)

- Identification of sub-themes

- Objective: no stone unturned

Building a Market Model

- Harvest of all market data available

- Assessment based on scientific & financial internal knowledge

- Objective: short and mid-term (5y) total addressable market and CAGR for every sub-theme

Sub-Theme

Allocation

- Initial allocation based on projected market size and growth rate

- Conviction-based sub-theme allocation tweak

Stock Universe

Definition

- Identification of all industry players

- Selection of companies most likely to capture each of sub-themes growth

Financial &

ESG Analysis

- Financial analysis

- Companies' investment case review

- Bear/Blue-sky scenario analysis

- ESG checks

Stock Selection &

Portfolio

Construction

Building a Conviction Portfolio

- Assessing the best risk-adjusted returns

- Implementing the sub-theme allocation

- 15-35 stocks

- Top conviction (6-10%)

- Strong conviction (4-5%)

- Good conviction (2-3%)

- Validation by the Investment Committee

Focused on growth themes

Our offering is sharply focused on several key growth themes. We strive at identifying early signs of upcoming strong trends and take full advantage of them by investing accordingly. Seizing them requires dedicated expertise.