There's panic everywhere – Stay calm as fear is a bad companion.

28 February 2020

Ever since the coronavirus (Covid-19) did spread outside China and most notably in Italy, the markets suddenly realized that the world's economic impact might be more severe than had been anticipated.

The words "Coronavirus," "Masks," "Pandemic," and "Covid" are among the most searched over the internet. Anxiety among investors is high. The February 2021 Fed fund future now prices a full percentage point cut and the spot Volatility Index has been north of 40% since yesterday, a level not seen for a long-time. Nevertheless, if we go beyond the very short-term, the picture is quite different: the July 2020 Volatility Index is only at 20%, an ordinary level.

It seems that the markets are preparing for the worst in the short-term, and the worst would be a world's economic recession (at least two consecutive quarters of negative growth). While this is a possibility if Covid-19 spreads around the world and the WHO (World Health Organization) declares a pandemic, we believe that it won't last for long, and recovery is likely to be very strong.

Newspapers are the only ones to benefit in the short-term, and we advise you not to read them. The more you read them, the more anxious you get. We don't want to underplay what is happening, but if we look at past episodes, the outcome tends to be quite clear.

We all know (health agencies around the world have been very vocal over the last few decades) that a potentially deadly virus pandemic is to occur sometime in the future. However, from what we understand of the Covid-19, this doesn’t seem to be the case. While mortality rates of the virus seem to be 10 times higher than of regular influenza, they are far less than SARS’ (severe acute respiratory syndrome) or MERS’ (Middle East respiratory syndrome). The worries are around the high transmissibility of Covid-19.

If we want to play a horror movie, the worst-case scenario would be to have highly deadly viruses such as SARS, MERS, and eventually Ebola, mutating (combining) with Covid-19 or regular influenza. In such a case, your savings are likely to be the last thing you would think about as the world would be in a standstill.

What are the possible "positive" changes going forward?

China has been and continues being the hot spot for new viruses due to the close proximity of animals (birds notably) to a large number of humans. Even though health authorities in the country have been trying to put health checks in wet markets (live animals are slaughtered in places crowded by humans), only a few follow these rules. Fresh (if not live) meat is preferred over chilled and frozen ones; the hope is to see such behaviors changing in the future.

Since the Covid-19 outbreak, Chinese authorities are currently amending (and coming up with new) rules that restrict trading wildlife, ban the consumption of wildlife meat. They have already closed 20k wildlife farms in the country. As Covid-19 spreads, governments around the world are also to step-up pressure on China and push the country for some permanent changes, notably on heightened hygiene standards.

We believe that politicians around the world, most notably in the US, are likely to slow down the pressure on the Pharmaceutical and Biotechnology industry as everyone now understands the importance of this industry when health crisis such as this one occurs. Nowadays, everyone is willing to pay whatever the price asked to have available vaccines in volume. A Covid-19 vaccine is likely to be found in the next few months if not weeks, given the number of public organizations and companies (e.g. CuraVac, Gilead Sciences, GlaxoSmithKline, Inovio, Johnson & Johnson, Moderna, etc.) working on it. The problem with vaccine manufacturing is that the Pharma industry is gradually exiting this business as it is loss-making. Once the peak of the outbreak recedes, no one is willing to pay anything for it. Are we ready to pay for a loss-making business just for the sake of security? How is it going to finance it? Today, as it has been the case in past outbreaks, everyone would say yes, but what when the situation normalizes?

As China is the manufacturer for the world (28% of the world's total vs. the second one being the U.S. at 15%), the current disruptions of goods have dire consequences for many industries and OEM's as seen with warnings ranging

from Apple to Microsoft. Will China speed-up the automation (robotization) of its production? Is 3D printing to take off once again as the manufacturing of goods needs to be closer to where goods are consumed? We will cover all these subjects in our next Investment Recipes issue which is to be published next week.

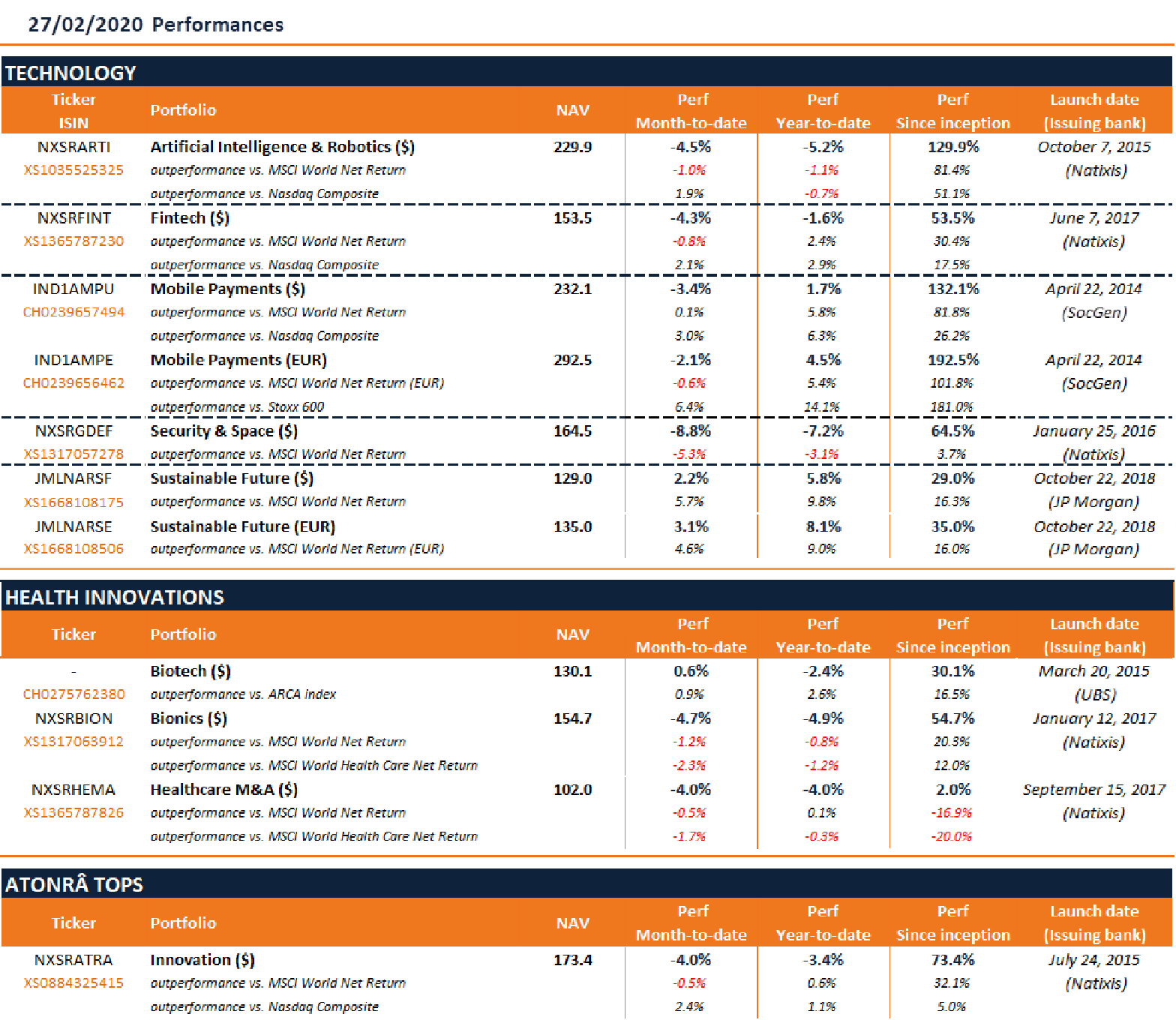

Performances as of 27 February 2020.

Below you can find the performances of all our products as of yesterday's (27 February 2020) closing prices. While we were able to hold up quite well vs. the MSCI World and Nasdaq for most of them, Security & Space did suffer the most so far as earnings coming out from Cybersecurity companies were not bright with Palo Alto Networks notably coming in well below Street’s expectations for a second consecutive quarter.

We would also like to inform our investors that in case we were to be confined at home, we have a business continuity plan in place. All AtonRâ employees have a remote access to our applications and can work from home.

Explore:

Disclaimer

This report has been produced by the organizational unit responsible for investment research (Research unit) of atonra Partners and sent to you by the company sales representatives.

As an internationally active company, atonra Partners SA may be subject to a number of provisions in drawing up and distributing its investment research documents. These regulations include the Directives on the Independence of Financial Research issued by the Swiss Bankers Association. Although atonra Partners SA believes that the information provided in this document is based on reliable sources, it cannot assume responsibility for the quality, correctness, timeliness or completeness of the information contained in this report.

The information contained in these publications is exclusively intended for a client base consisting of professionals or qualified investors. It is sent to you by way of information and cannot be divulged to a third party without the prior consent of atonra Partners. While all reasonable effort has been made to ensure that the information contained is not untrue or misleading at the time of publication, no representation is made as to its accuracy or completeness and it should not be relied upon as such.

Past performance is not indicative or a guarantee of future results. Investment losses may occur, and investors could lose some or all of their investment. Any indices cited herein are provided only as examples of general market performance and no index is directly comparable to the past or future performance of the Certificate.

It should not be assumed that the Certificate will invest in any specific securities that comprise any index, nor should it be understood to mean that there is a correlation between the Certificate’s returns and any index returns.

Any material provided to you is intended only for discussion purposes and is not intended as an offer or solicitation with respect to the purchase or sale of any security and should not be relied upon by you in evaluating the merits of investing inany securities.