The Unexpected Consequences Of Covid-19

10 March 2020

On 28 February, we wrote an article saying that the markets were preparing for the worst, a global economic recession induced by the spread of the Covid-19 virus. The past week has been quite dramatic, with both a significant increase in infections everywhere outside of China combined with financial markets reacting in panic. As if this was not enough, the energy markets went into a free fall (we cover this topic in the Sustainable Future theme) as the Saudis and Russians were unable to agree on output cuts. In that same article, we also wrote that the economic recovery would be robust.

At the time of this writing, our last statement seems to be less and less likely. The amount of fear is such that politicians across the world are starting to panic, usually a positive sign for the markets. Governments around the world, most notably in the U.S., are currently studying the possibilities (especially fiscal) of helping their economies cope with the current health crisis. While the IMF has suggested a coordinated action, we believe this is unlikely as there are too many diverging interests. The survival of Europe itself might be in danger if it is unable to tackle the current crisis in a coordinated fashion.

The purpose of this article is not to try to forecast when the Covid-19 crisis will end but instead to examine the possible mid-to-long-term unintended consequences and their impact on the different themes that we manage. Like for past crises, after the rain always comes the sun, and this time will be no different. For this article, we solicited contributions from everyone at AtonRâ, from engineers to portfolio managers, analysts, and salespersons.

The possible consequences stemming from crises are always difficult to assess as it requires longterm thinking, something that becomes even more challenging during periods of augmented volatility as market participants become focused on the very short-term.

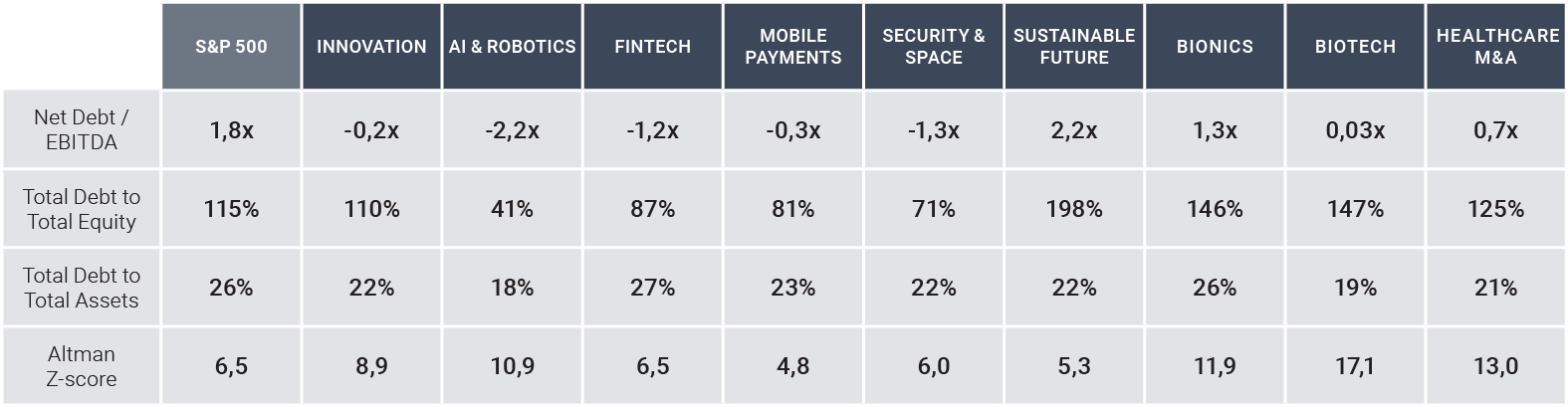

We thought that it would have been noteworthy for our investors to have a better understanding of the financial leverage of our portfolio's constituents in the current context where a credit crunch is one of the possibilities. We conducted a credit analysis on all the companies in which we are invested, and overall, our portfolios exhibit a better ability to service debt and lower financial leverage than the broad market. The quality of companies making up our portfolios is exceptionally high.

We would conclude by saying that the themes that we manage stand to benefit over the medium-term due to the current healthcare crisis. But for that, we need to have some patience and let time work in our favor.

We start our recap with a Macro view, followed by all the Investment Themes that we manage:

A Macro Overview

The global economy is now facing a dual demand and supply shock.

Demand destruction (quarantines and fear leading to lower consumption and higher savings) is usually deflationary. On the other side, supply disruption (factory and work shutdowns resulting in less supply) is typically inflationary.

The duration of these dual shocks is unknown, although China may provide a template for the coronavirus cycle, as we shall see below.

Lower consumption and investment through a dual demand and supply shock reduces growth output. There are ways to try to counteract this decrease in economic growth: either through lower interest rates and/or through increased government spending. However, interest rates are already quite low, and we believe that the marginal positive effect of further decreases in rates will be weak. Markets are currently adjusting to the above factors.

The price of equities can change for only two reasons, through changes in earnings or changes in the discount rate.

1. Earnings visibility is unclear from both the demand side (how much will consumers spend) and the supply side (how much will companies produce). Companies' earnings and their distribution over the next 12 to 18 months will depend on the duration and depth of the above two mentioned shocks.

2. The drivers of the discount rate are much more nebulous (inflation, investor liquidity preferences, demographics, etc.) Over the long run, the total return of stocks can almost entirely be attributed to earnings growth plus dividend yield and not to changes in the multiple. It does seem reasonable to assume, however, that the discount rates have increased markedly, especially in specific sectors such as for the energy, financials, and transportation sectors.

Corporate credit is similar to equities in that it provides exposure to corporate cash flows but in a more senior position in the capital structure. Credit spreads have widened a little, but not as much as equity market volatility might suggest. Loans generally end up on the balance sheet of banks. High default rates can lead to balance sheet impairment of the financial sector, and a pullback in new loans to other industries and companies, creating a snowball effect.

What comes next?

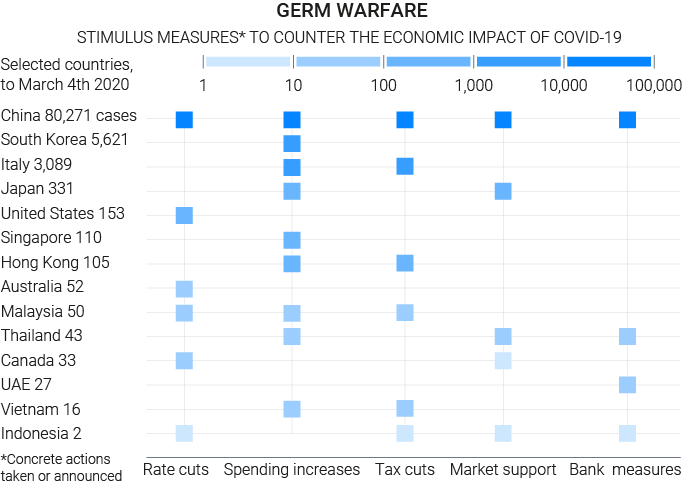

There are two ways to increase output exogenously: decrease interest rates or increase government spending. On the interest rates side, very few central banks still have this capacity (the Fed and the BOC), and lowering reserve requirements (China can act through this channel). Interest rates work in long and variable lags, so the impact is not felt right away in the economy.

Governments can increase deficit spending while at the same time benefiting from low-interest payments. It seems this is the most likely path authorities will choose to address the ongoing dual shock. (NB: for countries with negative interest rates, issuing self-liquidating debt decreases their indebtedness over the long run.) Additionally, deficit spending can be structured to have an immediate impact (ex: cutting payroll taxes in the U.S., cutting VAT, etc.).

The most likely scenario appears to be one where lower interest rates, lower commodity prices, and increased government spending should be highly simulative (a combination of easy monetary and fiscal policy, globally) and should drive corporate earnings.

The Bull Case For Equities

As mentioned, China is a good model of what may happen.

First, we should note that economic activity is slowing because of the preventive measures governments are taking against the spread of the Corona (and not because of the Corona itself). Overall, governments have been doing a decent job, given the low number of deaths. However, the economic cost is significative as shown by recent China PMIs, hence the market reaction.

From a 'pure' market/price action perspective, it seems that the markets are pricing a 100% recession (-20% equities, VIX at 50 and very low-interest rates). After a careful reviewing of the mortality rate, better visibility on the economic impact of the virus should lead the market to reprice.

Similar to China, we could have a V-shape recovery in the U.S. and probably a U-shape recovery in the E.U. – as always…

The Bear Case For Equities

A credit market seizure is a significant risk that can severely impact the economy. There is about $1tn of fallen angels (low-end of the investment-grade bonds which are in danger of being downgraded to junk).

A downgrade, due to a sharp sell-off in oil prices, could quickly spill over into the entire debt economy, worse than what happened in 2016. We note that there is no more issuance of Leveraged Loans, CLO, High Yield, and even I.G. corporate bonds.

The fiscal and monetary policies may not be as significant as the market expects. Moreover, a global recession is virtually impossible to avoid given Q1 in China/East-Asia. Adding the latter effects to the closure of Italy, and potentially other countries will be felt in Q2 and Q3 in Europe with negative GDP.

What's next for Equities?

As always, upon a (credit) crisis, companies that have good balance sheets should be able to survive. Moreover, after every crisis, there's always a change in perspective in how we do things. We believe that the corona impact on the thinking of people towards economics will lead to a reassessment or at least a different approach to globalization. The latter started a few years ago with the populist movements (Trump, Brexit, etc.) and the beginning of the trade war aiming to relocalization of capital and production. Moreover, there is a global movement towards a more sustainable economy and the reduction of carbon footprint due to climate change.

We believe that once the virus is out of the picture, the companies that should outperform are the ones that already have their means of production close to where they sell.

Artificial Intelligence & Robotics

We foresee a speed-up of automation (and robotization) in goods manufacturing in the medium-term: companies would try to rely less on the human ability to overcome output issues. We believe that many companies might want to relocate some of their manufacturing production closer to where goods are purchased. Still, in doing so, they need to be even more efficient (more automatization).

The unintended consequence of the outbreak is that China might lose over the medium-term its status of the world's manufacturing (China commands a 28% global share in production). We believe that fiscal stimulus targeted at stepping up Chinese spending would positively impact Chinese manufacturing and possibly cover the gap left by relocations outside China.

All-in-all the shift towards a much more domestic consumption-driven economy might come earlier than expected due to the current healthcare emergencies.

Mobile Payments

In the very short-term lower consumption negatively impacts this theme. Still, likely one of the investment themes with the most upside in the short-to-medium-term as the use of digital payments is expected to rocket due to hygienic measures (banks quarantining cash, consumers avoiding to touch bills and coins) and the rise of online shopping.

One of the main obstacles for Mobile Payments' broader adoption was the difficulty for some people (the elderly notably) to use it. The virus has one positive in that it obliges people to learn and use it. The WHO recommends using contactless payment technology where possible in order to slow the propagation of the epidemics.

Fintech

The coronavirus may have different consequences on the various sub-themes of fintech. While it is mostly positive for mobile payments (see above), more cyclical segments like online lending should be negatively hit in the short-term. On the positive side is that fintech allows us to do many things without a physical presence, 24/7 from anywhere.

Regarding software providers, the conclusion is not as clear. A global slowdown would impact the financial sector's bottom-line and thus their ability to spend. But as seen during the 2008 financial crisis, and as expected for some other industries (AI & Robotics notably), the financial sector will be obliged to streamline further its costs and with it to automate even more. We believe that some visionary organizations will take this opportunity to improve their customer experience by developing remote services and applications. Neobanks do not risk being shut down, given their lack of brickand-mortar agencies, and could gain additional market shares.

In addition to fiscal measures, governments around the world could also ease regulation to boost local economies. The regulatory framework is often named as one of the main issues that limit the development and the adoption of fintech services. For instance, South Korea is reviewing local laws limiting equity investments of non-financial businesses in financial entities, and vice versa. This decision could represent a major tailwind for the domestic fintech industry.

Security & Space

We are currently experiencing the world's largest-ever work from home program. Companies that used to have very rigid systems and legacy infrastructure are obliged to shut-down much of their operations with a significant economic impact. Organizations with flexible and cloud-based I.T. systems (Microsoft's Office 365, for example) stand to benefit in the mid-term where employees/students could work/study from home. Work-from-home programs could trigger internet traffic surges. Cloud services will have to maintain enough bandwidth and will be likely to experience increased attacks.

While some companies (financial industry notably) might want to use secured and mobile workspaces such as the ones offered by the likes of Citrix Systems, many of the smaller enterprises are likely to adopt less-secure and open-based solutions. In the mid-term, we believe that this is to trigger higher cyber criminality and might pose a more significant problem in the future.

The ramp-up in security checks and video surveillance will benefit from the outbreak, especially in China. The Chinese government has heavily relied on its network of cameras to contain the spread of the coronavirus, thanks to artificial intelligence, computer vision, and thermal imaging. Tech giants like Tencent and Alibaba developed applications where users can store their travel history, on which depends authorization to pass physical roadblocks. Cybersafety measures will have to be reinforced to protect these mountains of sensitive data.

Sustainable Future

We believe that once the Covid-19 healthcare crisis is behind us, the Climate Change theme might be the biggest winner. People across the world realize the benefits of a market slowdown (lower CO2/NOx emissions, less air pollution, as seen from NASA's images on China before and after Covid-19).

As discussed in the Artificial Intelligence & Robotics theme, people and corporations also realize the limits of globalization, promoting local production where possible. The best example of this is shown by Tesla, as it builds factories worldwide to be close to their point of sale. If you can take some manufacturing home, wouldn't it be better to take the production of energy at home as well?

We believe that private transportation might gain speed in China (we saw that contamination is more spread in crowded places and notably in public transports). Still, combustion-engine vehicles are not the solution as pollution kills way more than Covid-19. We remind our investors that China is the largest market for electric cars, and this is not likely to change in the foreseeable future.

With lower oil prices, deriving from what newspapers (we have a different view…might be more geopolitical and renewable-energy driven) say is a war between the Saudis and Russia, the impact on renewable energies could be significant in the short-term. Grid-parity (the cost of electricity being lower than electricity generated through fossil fuels) is more challenging to achieve with low fossil-fuel prices.

There is not a single car manufacturer in the world that is not developing E.V.'s, and with that, we believe this is a trend that is merely impossible to stop even if crude oil prices were to trade at $0.

Bionics

The virus outbreak prompted a spike in the use of telemedicine services, minimizing the demand for primary care, urgent care, and emergency departments. The U.S. notably has loosened restrictions for telehealth reimbursement.

We believe that on a mid-term basis, this technology could become mainstream. Physicians have been slow in adopting telemedicine (they are very reluctant to any change), and uptake has been so far limited to patients and providers. The positive about telemedicine is that it lowers overall healthcare costs as well. While not perfect as a system (some symptoms might get unnoticed with telemedicine), it helps to address an increasing number of patients, notably during emergency spikes. An emergency spike happens on average every three years with regular flu, which is more virulent than the previous years.

Awareness of the importance of real-time monitoring devices will surge too. People affected by chronic diseases (such as diabetes) will want a more immediate picture of their health situation, especially as other unexpected conditions may undermine their safety. The technology is there, and already deployed – it just needs to find wider adoption. Real-time monitoring will also increase the necessity to have data analytics platforms elaborating on patients' data. Indeed, the Covid-19 outbreak has proved that symptoms of some conditions such as heart failure may be indistinguishable from a respiratory virus (short of breath, increased transpiration). Being able to differentiate between patients to provide proper aid or avoid placing patients with a heart failure near Covid-19 patients is just as important. The industry might has finally realized that analytics, sensors and wearable multisensory patches must be widely accessible and work in unity with telemedicine services.

The virus outbreak has sparked the adoption of diagnostic tests for Covid-19. In the U.S., Quest Diagnostics and LabCorp introduced their Covid-19 diagnostic tests. On a longer-term basis, the FDA is designing a better development process for emergency diagnostics before and after an emergency. This plan could drive the design of a more efficient development process for diagnostic point of care

test. Diagnostic point of care is a new tool that is more readily accessible to providers (a test used in the doctor's office, hospitals, and clinics).

Biotechnology/Healthcare M&A

Which politician wants to play his future by pressuring the healthcare sector with pricing issues during a healthcare crisis such as this one? We bet no one…

The speed at which the industry was able to design new vaccines was spectacular. The cooperation between scientists all around the world is remarkable. More than 700 scientists are currently sharing an open/free database. During the 2003 SARS crisis, it took more than one year to obtain half of today's results.

We believe that the Pharma/Biotech and overall Healthcare industry will get out reinforced from this crisis. It would also restore public confidence and make the public aware that health conditions come above everything else and that a functional and efficient healthcare system is of paramount importance.

We also believe that raising public awareness for better health is taking place and is likely to last in the future. We saw that the virus is particularly dangerous for people having weaker health conditions and inadequate immune responses (tobacco consumption, high sugar levels, type-2 diabetes, respiratory problems, high blood pressure). Going forward, we believe that the demand for drugs treating those conditions is likely to increase, together with better diagnostic tools and prevention.

We have seen that the effects of globalization could have dire consequences. One of those is the supply chain of API (active ingredients), where everyone is dependent on Chinese's active ingredients. Sanofi, for instance, has the ambition to create a European leader in active pharmaceutical ingredients. The FED is also studying the possibility of having in the U.S. soil API ingredients secured. We believe that the collaboration between Biotech/Pharma and CDMO's (contract development and

manufacturing organizations) are likely to benefit, as shown by the cooperation between U.S. based Vir Biotechnology and Chinese Wuxi to produce antibodies. The CDMO industry will help to increase/ support the manufacturing capacity of biopharma companies.

We believe that once the current crisis ends, M&A activity is likely to intensify as some companies might take this opportunity to negotiate more favorable terms, more notably for companies that have difficulties in accessing financing.

Explore:

Disclaimer

This report has been produced by the organizational unit responsible for investment research (Research unit) of atonra Partners and sent to you by the company sales representatives.

As an internationally active company, atonra Partners SA may be subject to a number of provisions in drawing up and distributing its investment research documents. These regulations include the Directives on the Independence of Financial Research issued by the Swiss Bankers Association. Although atonra Partners SA believes that the information provided in this document is based on reliable sources, it cannot assume responsibility for the quality, correctness, timeliness or completeness of the information contained in this report.

The information contained in these publications is exclusively intended for a client base consisting of professionals or qualified investors. It is sent to you by way of information and cannot be divulged to a third party without the prior consent of atonra Partners. While all reasonable effort has been made to ensure that the information contained is not untrue or misleading at the time of publication, no representation is made as to its accuracy or completeness and it should not be relied upon as such.

Past performance is not indicative or a guarantee of future results. Investment losses may occur, and investors could lose some or all of their investment. Any indices cited herein are provided only as examples of general market performance and no index is directly comparable to the past or future performance of the Certificate.

It should not be assumed that the Certificate will invest in any specific securities that comprise any index, nor should it be understood to mean that there is a correlation between the Certificate’s returns and any index returns.

Any material provided to you is intended only for discussion purposes and is not intended as an offer or solicitation with respect to the purchase or sale of any security and should not be relied upon by you in evaluating the merits of investing inany securities.

.png)

.png)

.png)