Launch of the Blockchain & Digital Assets strategy

24 March 2022

Disintermediating the world

Bottom Line

We have been extensively researching blockchain over the past five years. Recent geopolitical and macroeconomic events convinced us that planets finally aligned for us to launch a new standalone strategy: Blockchain & Digital Assets.

Blockchain is changing the world and has an impact on all industries. It is now at an inflection point where the infrastructure phase is well-advanced, and the application phase will surprise everyone. As a result, digital assets start having real economic value and utility.

Our unique approach combines exposure to companies that are related or generate revenues from the distributed ledger ecosystem with promising digital assets. Our strategy offers investors a high correlation to Bitcoin while reducing the downside risk.

The Genesis Of A New Theme

The alignment of planets

The blockchain ecosystem is not something new for Atonra. We have been covering it extensively over the past five years. We recognized this technology’s potential from the beginning, but we needed to wait for the hype to pass and major catalysts to arise. Planets are finally aligned for the launch of a dedicated strategy!

- Recent geopolitical events and the risk of stagflation shall spark a crypto boom.

Our unique offering

The Atonra Blockchain & Digital Assets strategy relies on the same process as our other themes – theme mapping, market analysis, value chain study, etc. Purity is also essential. We invest in companies whose revenues are directly related to the distributed ledger ecosystem.

- This strategy is unique in offering exposure to both companies generating revenue from the blockchain and to leading digital assets.

Introducing sub-themes

After introducing the overall theme and its components, the last part of this special issue focuses on two essential sub-themes. First, we discuss blockchains beyond the usual candidates like Bitcoin or Ethereum. Then, we provide an update on miners, a sector that has become more organized and professional.

- Miners, the party validating blocks, will account for 25–35% of the portfolio.

- The selection of cryptocurrencies will be made through a dedicated process, focusing on their economic utility, adoption, and issue mechanism.

Investment Case

Why Now? The Best Alternative (Asset)!

A hedge against the risk of stagflation

Cryptocurrencies are considered a safe haven during high inflation periods. Supply chain issues and the war in Ukraine will impact economic growth and might keep inflation levels at a high level for a more extended period than previously expected. We recently discussed how stagflation is a growing concern.

- In March, the Fed revised its GDP growth estimate from 4% to 2.8%, and FOMC members project median inflation for 2022 at 4.3%.

Being selective with real assets

Historically, real assets navigated better through such periods. High-quality stocks with pricing power and free cash flows remain a natural candidate as ultimate owners of tangible assets. Moreover, digital assets can confirm their role as a store of value in such an environment.

- Cryptocurrencies are appealing because they are independent of central banks’ policies – and thus politics.

Other real asset classes are not as appealing

Real estate is at an all-time high, boosted by the low yields of the past few years. The tighter monetary conditions in the developed countries could act as a boomerang on the housing market. Moreover, the crisis in Eastern Europe is literally about commodities. Investing in commodities now requires special skills.

- U.S. houses were up by 18% YoY in Q4 2021.

- As rates go up, applications to refinance homes were 49% lower YoY in early March. Home prices may suffer a ripple effect from higher long-term yields.

Embrace The Digital Gold

The hidden risks behind gold

The debate of gold vs. Bitcoin is all the rage. Both have a low correlation to traditional assets and are complementary. However, given the current situation, holding gold appears riskier. Russia may be forced to sell its vast gold pile as other reserve assets are sanctioned, pushing down gold prices.

- Russia is the 5th country globally in terms of gold reserves.

- Russia’s current reserves equal roughly a full year of global gold mining.

A defined supply that is not adjusted when prices increase

Bitcoin supply is limited and self-regulated. By opposition, commodity suppliers will tend to adjust the production when prices go up. Mines that were not profitable become profitable once a threshold is crossed. Oversupply is never far away for traditional commodities, causing volatility in commodity prices.

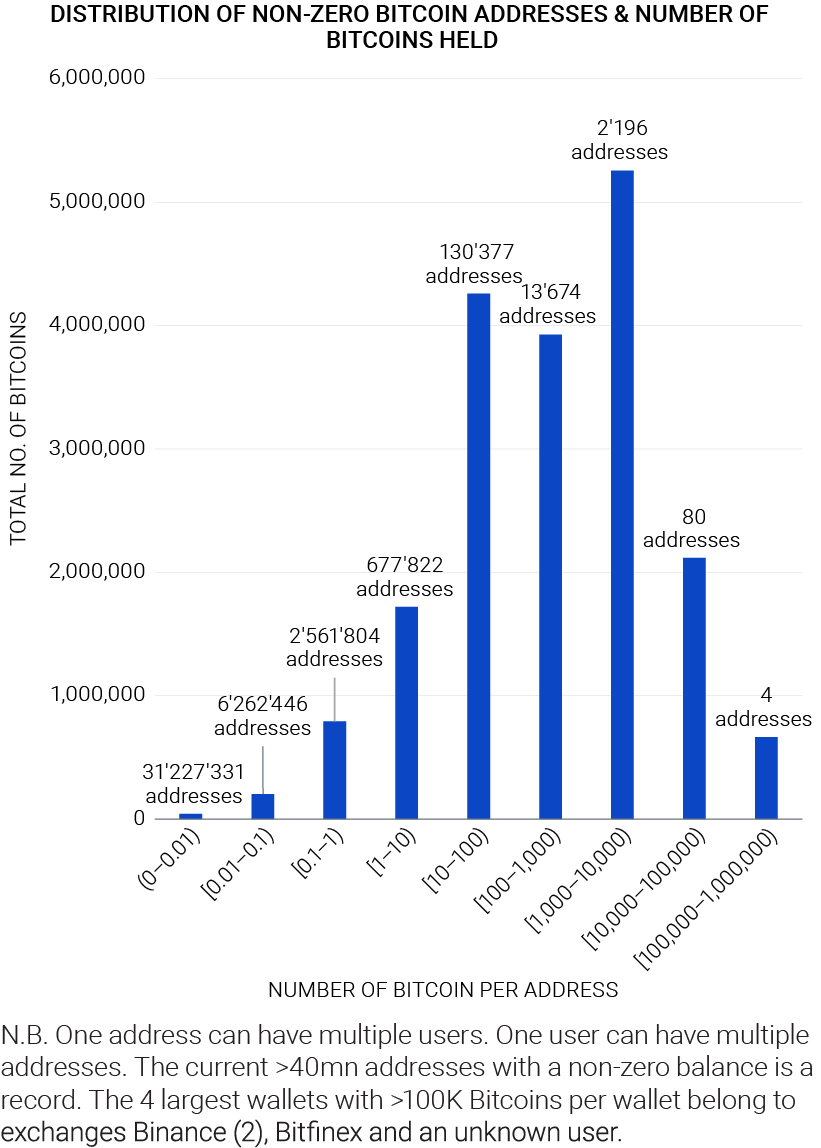

- Bitcoin’s maximum supply will never exceed 21mn BTC.

- It will take ~120 years to mint the remaining 9.6% blocks.

Scarcity is essential

Other cryptos also limit their supply. The Ethereum protocol burns transaction fees at each newly minted block. Limiting the supply ensures that the token’s price appreciates as adoption rises.

- 1,3mn ETH (~$5bn) were burnt in 2021 on the Ethereum protocol, after the London Fork. The more the network is used, the more ETH is burnt.

- Leading exchange Binance issued 200mn coins, used for discounted trading fees, payments, or entertainment. It is gradually reducing the supply to 100mn coins.

Decentralized But Scrutinized And Political

Biden’s executive order on digital assets

The White House recently set out a national policy for digital assets. It legitimates the role of cryptos in the global economy and U.S. society. A clear regulatory framework is positive for innovation and adoption.

- The U.S. Congress will have to prepare the actual regulatory framework.

- Europe is developing its regulatory framework, Markets in Crypto Assets (MiCA), which shares similarities with MiFID regulations of traditional assets.

The impact of the Russia-Ukraine war

Among the unintended consequences of the war in Ukraine, digital assets were brought under the spotlight. Fears about digital assets being used to bypass sanctions did not materialize. Most digital assets are traceable, and the ecosystem abides by international sanctions. Meanwhile, Ukraine called for crypto donations.

- Bitcoin and USD-stablecoins volume from RUB trades rose to 9-month highs.

- Coinbase initially blocked 25’000 accounts potentially linked to sanctions.

- Ukraine apparently received >$100mn in crypto donations, proving its ease of use.

Adopting cryptos as legal tender

When El Salvador made Bitcoin a legal tender in 2021, the International Monetary Fund was outraged. Other countries are now considering the move. Cryptos allow these emerging countries to cut their reliance on the U.S. dollar, reduce cross-border remittance costs, and attract foreign investments.

- Panama, Paraguay, and Cuba are considering adopting Bitcoin.

- A central bank digital currency is an alternative to decentralized digital assets. Nine countries, mainly in the Caribbean, have already launched their versions of CBDC.

The Inflection Point Is Now

Towards mainstream adoption

Blockchain awareness has just started to reach the masses. Beyond the improved user experience, standards development is essential, like for any innovation. After years of working separately on different projects, the blockchain community is taking a more collaborative stance for the benefit of all.

- The trend growth of crypto users of >100% per year is superior to the adoption rate of the internet in the early 90s (~65% per year).

Ready for real-life applications

The advances in blockchain, like improved speed and scalability with layer 2 protocols, improved chain interoperability, or proof-of-stake consensus developments, are paving the way for real-life applications. The infrastructure phase is well-advanced. The application phase will reshape the world.

- Investments are flooding the sector, boosting innovation.

All is possible, thanks to technology

The current state of blockchain would not have been possible without significant developments in chips. Specialized hardware has made blockchain operate more efficiently and cost-effectively.

- Designing and maintaining a blockchain involve thousands of parameters, as well as a trade-off between scalability, security, and decentralization.

- As it advances, blockchain will converge with artificial intelligence, creating smart blockchains with higher performance and better governance.

Blockchain Outlook

Getting rid of middlemen

Blockchain-based smart contracts will play a vital role in the ongoing automation of the world. Specified rules will apply automatically once predefined conditions are met. The need to rely on middlemen to verify transactions will become useless, eventually reducing administrative burden, transaction time, and costs.

- This will impact all industries: finance, supply chain management, production, legal, real estate, media and entertainment, energy, cybersecurity, etc.

Fractional ownership and financial inclusion

Blockchain redefines the concept of ownership. With no effort or complex paperwork required, individuals can acquire fractions of tokens that represent assets. What was accessible to only a few becomes accessible to everyone. Non-fungible tokens are here to stay.

- The list of potential assets is limitless, but tokenization makes sense for non-mainstream goods, like (digital) art, real estate, or football teams.

The backbone of Web 3.0

What if the internet was not in the hands of a few big tech companies? This is the premise of the next internet, whose foundation will rely on blockchain technology to be decentralized and open. Individuals will better control their data that will not be linked to any specific platform.

- Ethereum is currently the largest community-run decentralized network, with ~2’000 live applications in finance, gaming, marketplace, social network, etc.

- Taking control of one’s data also implies the ability to better compensate creators of content, with no or fewer intermediaries.

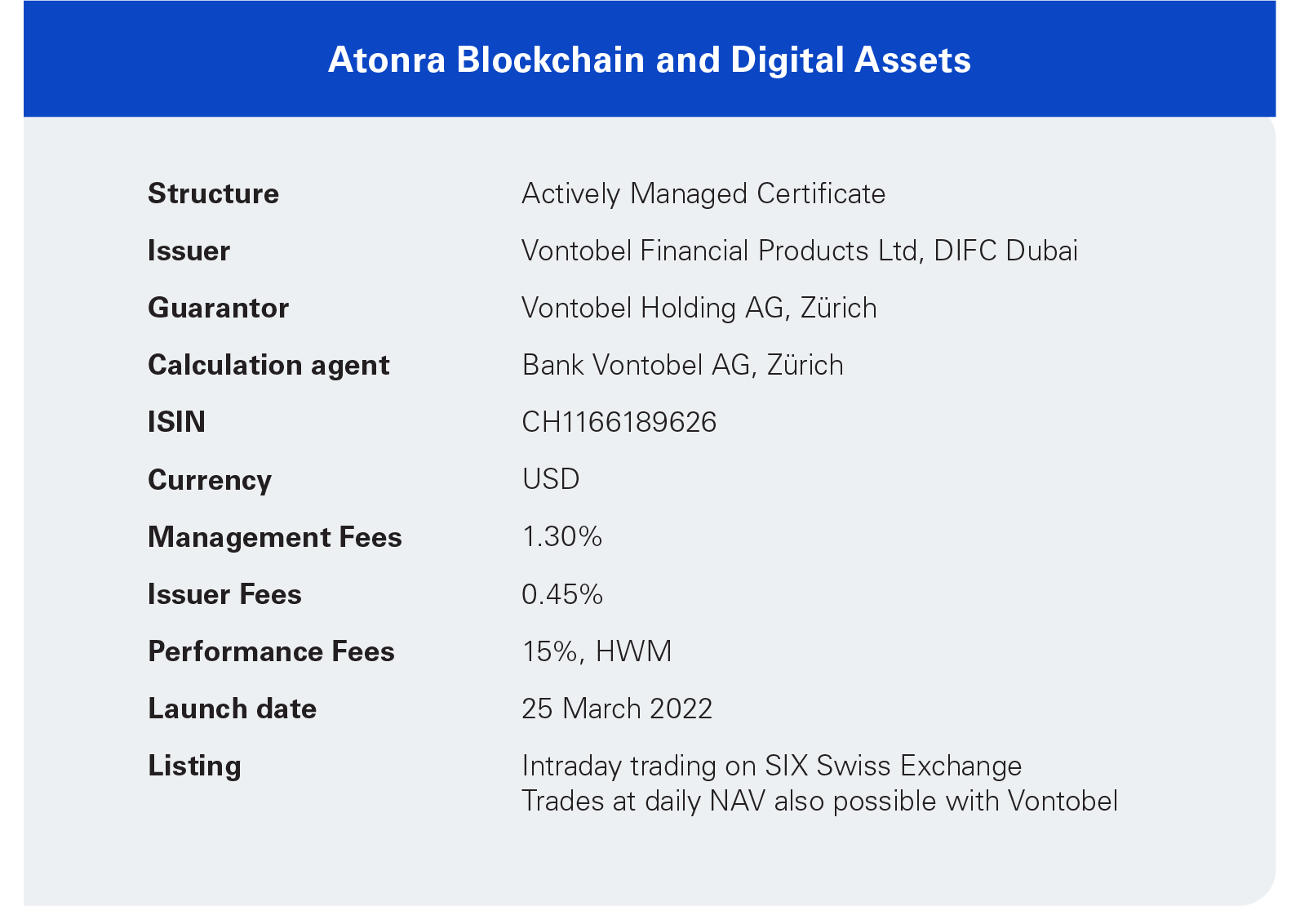

Atonra Blockchain & Digital Assets

The best of two worlds

The strategy is a first of its kind, providing exposure to both companies generating revenue from the distributed ledger ecosystem and eligible digital assets.

- The Atonra process, which identifies and maps the sub-themes, analyzes the value chain, etc., is also applied for this theme.

- The investment process is adapted for digital assets, for which the use cases, the economic utility, and the scarcity are also considered.

- The listed universe about the blockchain is expanding, increasing its breadth.

Expected risk/reward profile of our strategy

The targeted companies' revenues and growth depend on the blockchain developments and the underlying prices of cryptos. Our portfolio is built to have a high correlation to the digital asset ecosystem with concrete business models.

- The expected correlation of the portfolio to Bitcoin will initially be >0.8, with reduced downside risk (downside capture ratio of ~75% compared to Bitcoin).

- For instance, a crypto exchange will have more revenue when adoption rises. A digital asset bank will have more custody fees when crypto’s price appreciation boosts assets under management.

Impact on existing strategies

Blockchain will remain a sub-theme of Fintech since the disruption of the financial industry is among the main potential applications of this technology. For the time being, we do not intend to add the Blockchain & Digital Assets strategy to The AtonRâ Fund.

We initiated in our Fintech strategy exposure to blockchain companies in early 2021. The current exposure to the sub-theme is ~15%.

- The CSSF does not accept the exposure to digital assets in UCITS funds yet.

The Benefits Of Cryptos For Asset Allocation

Institutional money on the rise

The question from institutional investors has changed from “why should I hold cryptos” to “why should I not hold cryptos”. Despite a lack of appropriate structures like ours, institutional investors are building positions in the crypto space. This move is only starting.

- Listed entities, governments, hedge funds, and even pension funds like the Houston firefighters' pension fund have allocated funds to digital assets.

Improvement of portfolio metrics

Adding digital assets to an asset allocation would have improved key portfolio metrics like total return, Sharpe ratio, etc., compared to a classical 60/40 portfolio.

- Any investor with more than 25% exposure to equity can get higher returns for the same level of risks by including 3% of Bitcoin in the asset allocation.

- The portfolio risk metrics improvement is valid for an allocation as small as 1% or for a more significant allocation such as 5% (e.g., in the case of a complete replacement of a gold allocation).

Volatility should not be a concern

Historical volatility may have restrained some investors from participating in this new asset class. Investors should instead focus on correlation with other asset classes, which has been low. The increased adoption by institutional investors will reduce digital assets volatility and maximum drawdowns.

- The 3- and 5-year correlations between Bitcoin and the Nasdaq are at only 0.34 and 0.22, respectively.

- In bear markets, short-term cross-asset correlation increases, even for Bitcoin.

- As technology matures and disrupts Web 2.0, the correlation with Nasdaq is likely to fade away further.

Overview of Sub-Themes – Blockchain

Miners

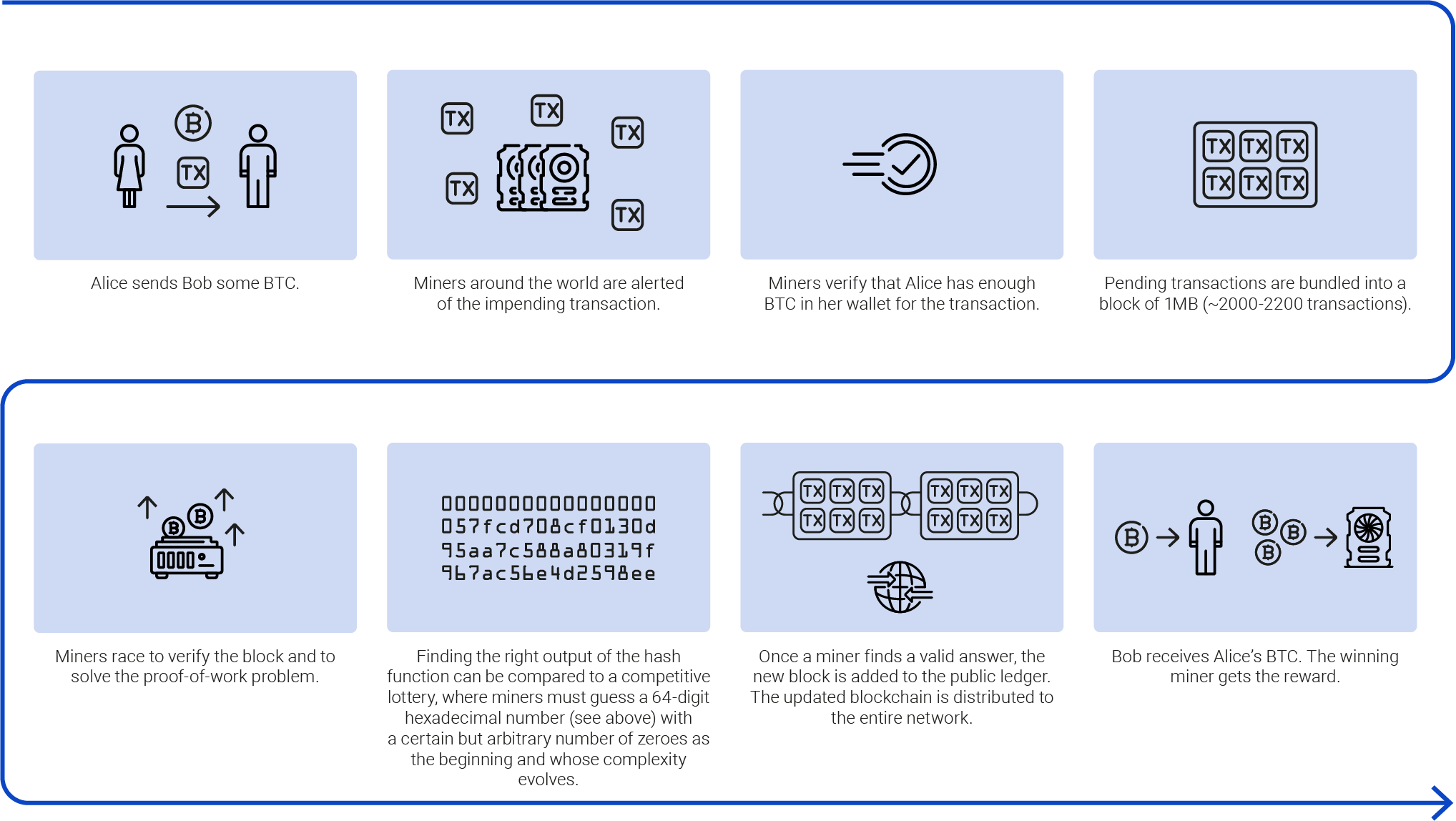

Miners ensure that all transactions on a blockchain are legitimate. They compete against each other to verify transactions and are rewarded for their work with tokens. Mining is an activity that requires computational power and energy.

- The net operating revenue of miners is a function of crypto prices minus the electricity and maintenance costs.

- In 2021, Bitcoin’s miners generated revenue of $17bn, Ethereum’s $18bn.

Mining hardware

The time when mining with personal computers was profitable is over. Rising crypto prices have pushed companies to professionalize this activity and acquire more powerful and efficient computing components.

- Each protocol has its preferred hardware, depending on the mathematical puzzle to be solved. Bitcoin is mainly mined with Application-Specific Integrated Circuits (ASICs), while Graphics Processing Units (GPUs) are better tailored for Ethereum.

- The crypto mining hardware market should reach $12bn in 2026 (7.5% CAGR).

Other specialized hardware

Crypto hacks often make the headlines. A simple solution to prevent getting hacked is to secure the digital assets on devices not connected to the internet, a practice known as cold storage.

- $196mn were stolen on BitMart’s hot wallets in December 2021.

- Coinbase claims to store 98% of its 89mn users’ assets offline.

- This market is anecdotal (<$1bn by 2026) but growing at CAGR >25%.

Exchanges

This category refers to companies that provide customers with platforms to trade digital assets. Like traditional stock exchanges, they represent a meeting place for sellers and buyers.

- The total crypto value exchanged in 2021 was multiplied by 7x vs. 2020.

- In terms of volume, Binance has a market share of >50%.

- Trading fees vary from a few basis points to >250bps, depending on the regulatory status of the exchange and the targeted investors.

Financial services

The number of companies acting as a bridge between traditional and digital finances is rising. This is required to increase the penetration rate of digital assets. Blockchain technology will go beyond disintermediating the financial industry. DeFi offers everyone equal access to the markets.

- This bridge takes the form of custody services, asset management, or payments.

Crypto payments

Leading payment-services providers propose to their merchants new solutions to accept payments with cryptocurrencies – either online or in brick-and-mortar shops. Moreover, blockchain has a role to play to improve the efficiency of cross-border payments and will be essential for the finverse.

- The latest loyalty schemes developed for payment cards involve the possibility to accumulate and spend cryptos.

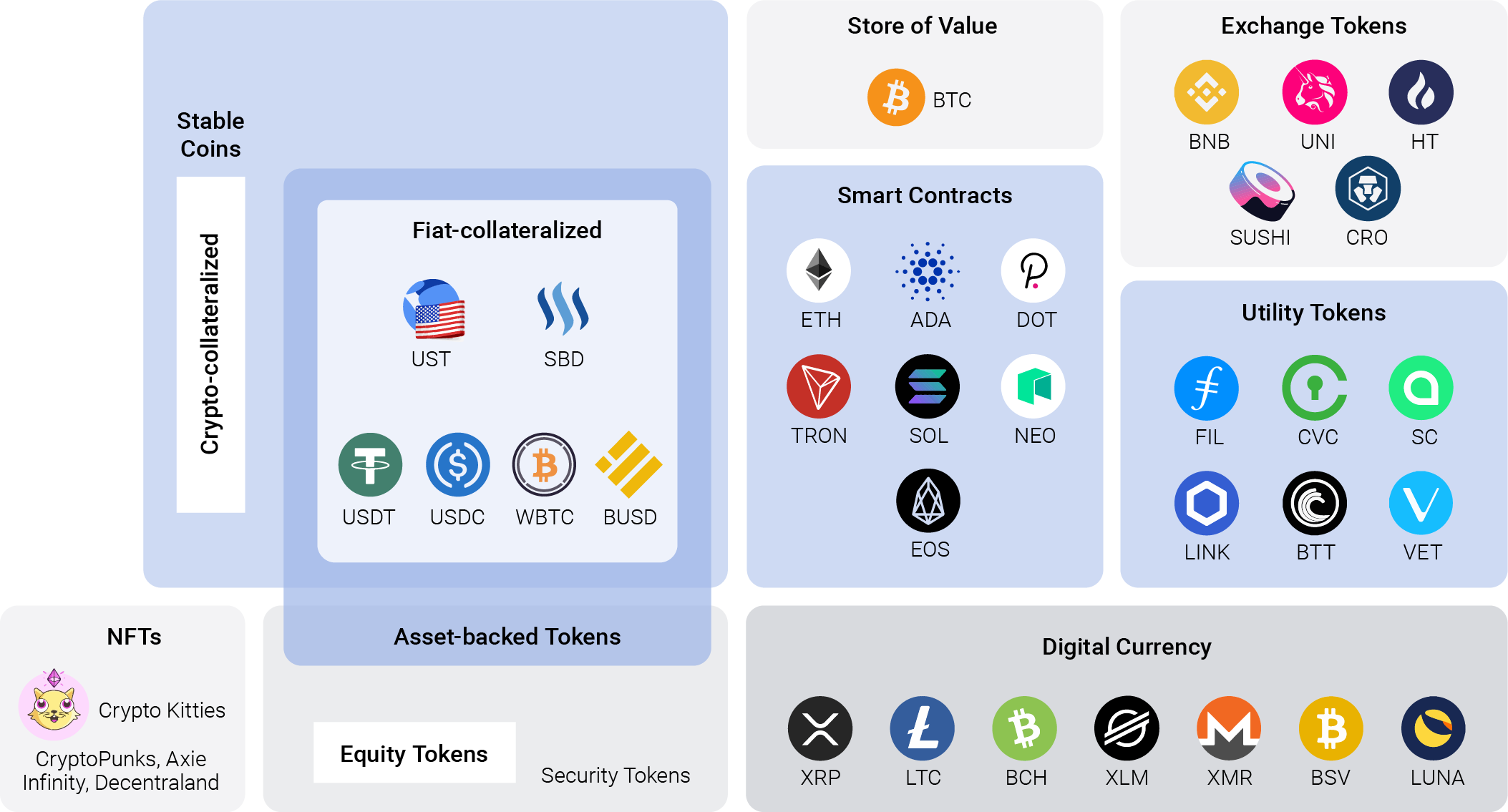

Overview of Sub-Themes – Digital Assets

Treasury management

Many public entities use cryptos, mainly Bitcoin, as treasury reserve assets. These firms pursue a buy-and-hold strategy. The correlation to Bitcoin depends on the size of the digital asset holding compared to the balance sheet and on the core business activity.

- >30 listed companies hold cryptos on their balance sheet.

- Listed companies hold ~1% of the maximum supply of 21mn Bitcoins.

- Microstrategy and Tesla have Bitcoins worth ~$5bn and $1.6bn, respectively.

Tokens and cryptocurrencies

The investment universe of digital assets is expanding exponentially. Delta-1 refers to investment vehicles directly tracking the performance of digital assets. This allows the strategy to gain exposure to promising protocols.

- CoinMarketCap is currently tracking >9’500 digital assets, more than double the number of companies listed in the United States (~4’000).

Listed investment vehicles

While the SEC has still not approved any ETF investing directly into Bitcoin or other cryptos, other countries like Canada or Switzerland have defined a clear regulatory framework for digital assets.

- Canada approved the first Bitcoin ETF in March 2021.

- There exists U.S. ETF that invests in Bitcoin futures.

- Listed investment vehicles hold ~4% of the maximum supply of 21mn Bitcoins.

Catalysts

- Blockchain-as-a-Service. Developing blockchains require special skills. The need for outsourcing this task will become blatant. Business models that design protocols and maintain the infrastructure are already emerging.

- Regulations. One billion people will be using digital assets in 2024 (from 300mn today). All parts of the world are developing their regulatory framework, which is essential to support development efforts.

- IPOs. Several blockchain companies are on the starting block to become public entities. Each new listing increases investors’ awareness about blockchain and extends our investment universe.

Risks

- Volatility. Digital assets represent a new asset class with its own cycles. Historically, volatility has been significant. But it will tend to fade as institutional investors initiate exposure to this asset class.

- Hacking. Hackers have many possibilities to try to steal digital assets, e.g., through the protocols, the digital custodians, the exchanges, etc. The security of each of these links will have to be strengthened.

- Manipulations. Large quantities of major cryptocurrencies are in the hands of a few wallets. The so-called crypto whales have the potential to impact crypto prices. However, substantial sales would be painful only in the short term.

Source:

Federal Reserve (GDP growth and inflation estimates as of 16 March 2022), FRED, Mortgage Bankers Association, AtonRâ Partners, Blockchain.com, Binance, Refinitiv/Eikon, WatchTheBurn, Investopedia, Revix, CB Insights, Security and Communication Networks vol. 2021, State of the DApps, Past performance does not guarantee future results. Metrics provided refer to backtesting of the strategy, using 1-year daily data, Analysis done with 3- and 5Year of monthly data until February 2022. Monthly rebalancing. Bitcoin is used here as a proxy to the crypto space. The graphs focus on the 5-year analysis, The Block, The Block Legitimate Index, Coin Metrics, Coinbase, The Block Legitimate Index, Crédit Suisse global Wealth Databook 2021, Bitcointreasuries.net, CoinMarketCap, McKinsey

Companies mentioned in this article:

Coinbase (COIN US), Microstrategy (MSTR US), Tesla (TSLA US)

Digital assets mentioned in this article:

Binance (BNB), Bitcoin (BTC), Ethereum (ETH)

Beyond Bitcoin And Ethereum

Bottom Line

BTC and ETH laid the brick foundation and infrastructure of the blockchain, which won the race for the fastest asset to reach $1tn in valuation. After years of use, two types of players are entering the market: competitors trying to capitalize on BTC/ETH structural shortcomings by setting up more advanced protocols, and Enhancers, which are trying to build applications and use-cases on top of existing blockchains.

Our portfolio will leverage the current blockchain ecosystem by being exposed to the tokens of the challengers in the L1 blockchain, leading players in the L0 blockchains, and the scaling solutions providers in L2.

A World Of Blockchains Relies On More Than BTC/ETH

The Layer concept: blockchains do not operate on the same level

Blockchains are not all competing protocols. Some rely on founding blockchains to enhance their characteristics (Layer 2), build use cases (Layer 3), or interface directly with end-users (Layer4).

- 2010–2018 – Rise of the layer1: Bitcoin and Ethereum for the foundation.

- 2018–2021 – Rise of the layer2: Chainlink and Matic are examples.

- 2022 and beyond are poised to see the growth of layer 2-3-4.

The battle for network effect is raging

Not all blockchains in layer 1 (L1) are born equal in performance. Despite some being “better” on paper, the network effect and adoption will be the sole deciders.

- Bitcoin and Ethereum are currently too expensive in gas fees to be used as “currencies” but capture most traffic.

- This duopoly is disputed by Solana, FTM, and other L1. Numerous competing layer1 tokens appreciated 5x to 50x in 2021, showing how speculation and real need combined to push the system.

The explosive tokenomics and its applications

What is changing the face of blockchains is the utility factor. Tokens are not only a cryptocurrency, and they serve a purpose. This is the starting point of DeFi and Dapps (decentralized applications), including games.

- DeFi: Total Value Locked went from $20bn in 2020 to $250bn in 2021.

- GameFi: The collective market capitalization of top games breaking $20 billion in 2021, making 11% of the entire 50 years old gaming market within one year.

The Ecosystem Beyond Btc/Eth At A Glance

The Layer1 Battle Is Big And Bound To Stay Big

The importance of L1 blockchains

Nothing happens without them, which make currently their tokens the most traded assets. But not all are equal. L1 blockchains face a trilemma: security / scalability / decentralization and cannot act on all fronts simultaneously.

- Around >50% of all traded cryptos belong to L1 blockchains.

- BTC can sustain 7 transactions per second, ETH 15 and Solana 15’000. BTC and ETH are very secure and decentralized, Solana is scalable but centralized.

Centralized vs. decentralized: a performance vs. risk dilemma

One of the main risks in crypto is a 51% attack. Protocols are based on consensus. If a single entity controls >51% of the network, then the distributed ledger could be rewritten, and double-spending possible. But other risks linked to centralization also include overload and downtime for transaction processing.

- If the 51% attack is only possible in theory, Solana has already been down 6 times for >8h over the last 3 months resulting from an overload of transactions (reaching up to 400k per second) due to a strong centralization.

Upgrading current protocols will not yield a perfect blockchain

Bitcoin and Ethereum are currently in their proof-of-work (PoW) phase, meaning miners must show they have computed and put their GPUs at work to mine a new block and gain the reward. Ethereum is pushing for a proof-of-stake (PoS), where new blocks are only validated if users stake their tokens (and get the reward).

- PoS removes most of the energy consumption and enables faster transactions at a lower fee (called “gas”), thus improving scalability. But it loses on the security level.

- Other consensus algorithms are currently being tested.

Layer 2 Scaling Solution Are Just Getting Started

Why everything cannot be done on an L1

Hard limitations in Layer1 blockchains, such as transactions per second, create bottlenecks that propel gas fees through the roof. Layer 2 solutions aim at tackling scalability without compromising the integrity of the underlying blockchain.

- Buterin, the Ethereum founder, said: “Rollups (layer 2 scaling solutions that perform transaction operations off the main Ethereum blockchain, but still post the transaction data onto layer 1) are in the short- and medium-term, and possibly in the long-term, the only trustless scaling solution for Ethereum”.

- Layer 2 solutions also reduce the carbon footprint (Less gas = less energy).

L2 scaling solutions are still looking for their champion

Although we are still in the infrastructure phase, the transition to the application phase made it blatant that most applications such as blockchain gaming would require 10 to 1mn times more transaction bandwidth. Competition for L2 scaling is currently red hot.

- Currently, four solutions are competing for scaling the ETH protocol.

- Polygon (Matic) raised $450 million last month, Starkware plans on raising at least $100mn, Optimism just raised $150mn.

L0 may also alleviate the scalability issue

Layer 0 protocols aim to improve scalability by enabling interoperability between the protocols. This philosophy postulates that blockchains should be fungible to the Dapps creators. Optimally combining the L0-L1-L2 mix should allow the Dapps creators to yield the best results.

- Avalanche (AVAX), Polkadot (DOT), and Cosmos (ATOM) are the main competitors within this “ecosystem of blockchains”.

It Is Not About Holding Tokens It Is About Using Them

Tokenomics is the crucial part of the new digital economy

Tokens’ value is driven by speculation but also by their use case. Decentralized Autonomous Organizations (DAO), the web 3.0 de facto companies, define a roadmap specifying how the token they issue is expected to behave: be minted, burned, staked, pooled, traded, or used for. Owning tokens often give voting rights.

- DAO are companies that operate almost autonomously on a blockchain. There is no hierarchical management system like in traditional companies. DAO’s creation is one of the first use cases of Smart Contracts.

The utility of tokens will grow with DAOs

Currently, the crypto space is a jungle with over >10k tokens. Despite a sizeable number of scams behind them discrediting the overall space, 2021 showed the public interest in crypto and DAOs, which expand beyond the scope of digital currencies into digital projects and digital assets with a democratic process.

- In 2018, only 10 DAOs existed. Now there are >4000 with >$75bn in funding.

- Among the leading actor in the space, we find MakerDAO, DeFi’s largest central bank and creator of the largest decentralized stablecoin DAI or UniswapDAO, the largest decentralized exchange.

“Hodling” is not the only strategy

As explained, most Tokens have a purpose besides being “hodl”, the crypto slang for the “buy and hold” strategy. And even if the investor’s goal is to “hodl”, then DeFi mechanisms enable numerous passive income revenues.

- Yield farming is a strategy to lend crypto assets for interest to DeFi platforms.

- Staking is a strategy to get rewards in the PoS mechanism by locking several tokens.

Catalysts

- L1 Blockchain adoption outside cryptos. Settling on a smaller number of blockchains will facilitate the transition to the application phase by consolidating standards.

- Wallet insurance and services. Currently, all the wallet risks and actions are undertaken by the customer. To facilitate mass adoption, additional protection for customers is needed.

- Pro-crypto regulation for DeFi. Derisking of DeFi protocols could push a massive inflow of money from institutional investors.

Risks

- Regulatory risk. With rising CBDC projects from central banks and fears of fraudulent activities, there is a distinct risk of bans or restrictive regulations on public cryptocurrencies.

- Hack risk. When not on cold storage, all digital assets are at risk. The blockchain may be harder to hack, but the users are not.

- Unexpected scam. Some high-profile projects in the crypto space have turned out to be scams. Knowing the team behind the project is a first protection layer as leaders in the crypto space would not risk their reputation.

Source:

Insider Intelligence, CoinDesk, GameFi, AtonRâ Partners, Statista, Solana, VentureBeat, DefiPulse, Forbes, Binance, Dappradar

Companies mentioned in this article:

MakerDAO (Decentralized), Metaverse Holdings Ltd. (Private – owner of Decentraland), TSB Gaming Ltd. (Private – owner of SandBox), UniswapDAO (Decentralized)

The Picks And Shovels Of Disintermediation

Bottom Line

Miners and validators are the backbones of any blockchain network, verifying transactions and allowing decentralized finance to exist. Given the massive power requirements for mining and proof-of-work validation, the sector has been receiving a sideways glance for sustainability reasons (despite using less energy than what’s needed to power the world’s Christmas lights). The trend is finally reversing as miners, motivated as much by self-interest as climate concerns, transition from carbon neutrality to 100% renewable energy, which tends to be cheaper than fossil energy. Additionally, the transition to proof-of-stake would massively lower energy consumption.

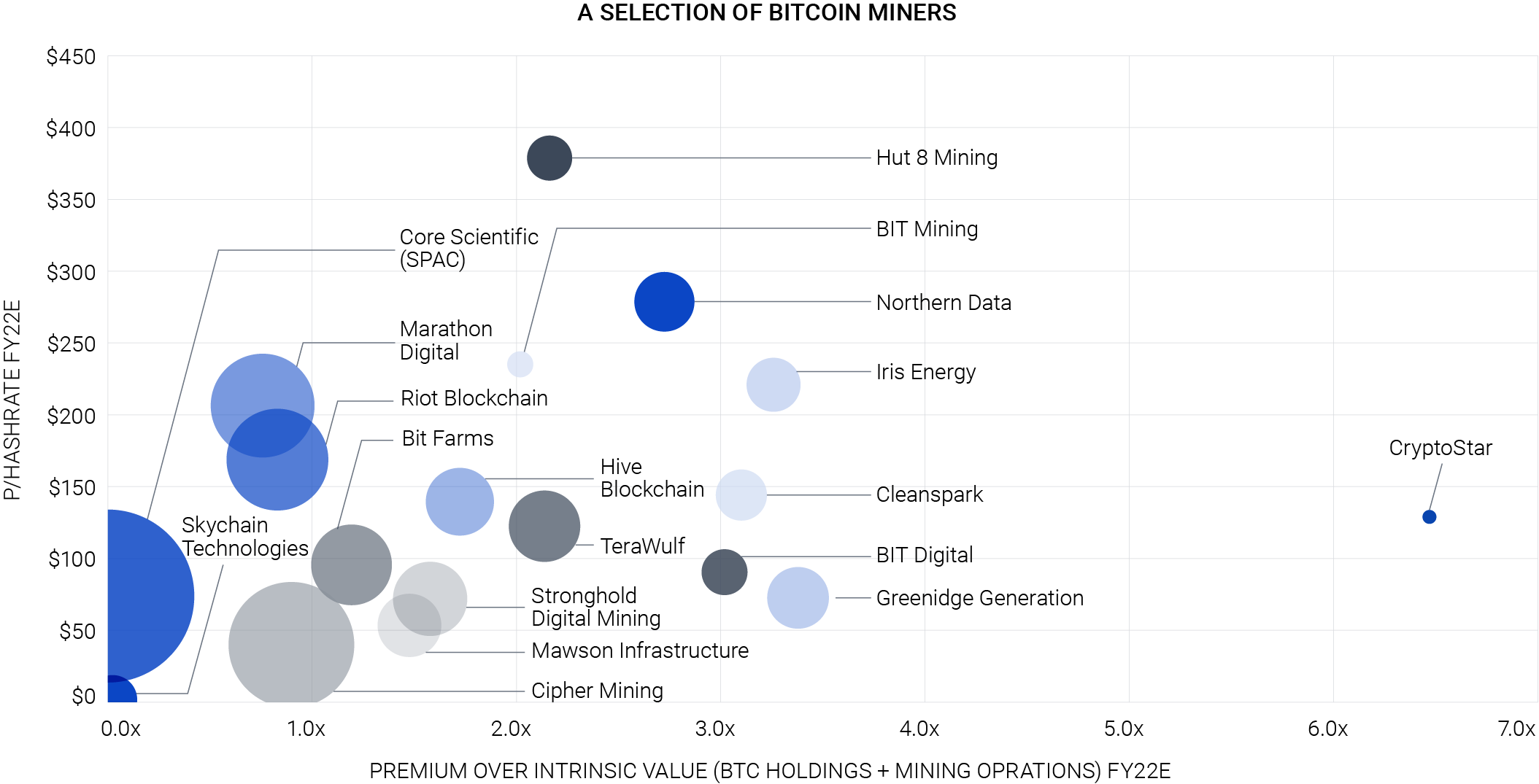

To expose our portfolio to miners and validators, we focus on companies with high mining efficiency, significant potential market share, and a strong balance sheet cushion of already mined assets. We pay special attention to miners that rely on or transition to 100% renewable energy sources.

The Cornerstone Of Blockchain Network

Making decentralization possible and secure

Miners have the crucial role of monitoring, verifying, and validating transactions, ensuring blockchain’s authenticity without relying on a traditional central or banking authority, e.g., a central bank.

- As part of the job, miners also prevent malicious attacks and make sure transactions are not reversed or coins double-spent.

- In a previous article, we introduced and explained the role of cryptominers.

From power-hungry proof-of-work to efficient proof-of-stake

When the last Bitcoin is mined, miners will have to diversify. The process has started today with miners changing the validation mechanism from “working” to “staking”.

- Proof-of-work (PoW) miners compete on computing power to solve numeric problems, e.g., Bitcoin, Ethereum 1.0. They get rewarded for the ”mined” blocks.

- Proof-of-stake (PoS) validators stake coins to participate and are randomly picked to create a new block, share it with the network, and receive a transaction fee.

Taking responsibility for the environment

When mining started to burn more electricity annually than Norway, miners began changing their target from being carbon-neutral to using entirely renewable energy.

- >75% of miners use renewable energy in their operations, and for many, 100% of power comes from carbon-neutral energy sources.

- Bit Farms has vertically integrated with an electric company and runs on 99% renewable hydroelectric energy.

- Stronghold Digital Mining converts the waste left over from coal mining into power, earning tax credits.

- Riot Blockchain already runs on ~90% zero-emission sources.

Towards Efficiency And Infinite Potential

Testing a more efficient consensus mechanism

Consensus mechanisms are a way to validate transactions in a decentralized manner. Some blockchains such as Ethereum are testing the new PoS mechanism. In summary, with PoS, validation is not done by who has more computing power but has more wealth. If the transaction is correctly validated, stakers are rewarded with ETH. If they attempt to trick the network, the staked ETH are lost forever.

- Staking will thus alleviate competition in terms of computing power, allowing miners/validators to use older gear and decreasing global technological waste.

- PoS is presented in the diagram here to the right, PoW on the next page.

A market with a huge potential

Today, miners’ revenues consist in the mined Bitcoins, with costs mainly being PPE amortization and the electricity used for running their facilities. With “staking,” energy consumption for PoS is said to be 99.99% lower than PoW. This means lower price per “minted” or “forged” coin and improved profitability.

- The staking market is set to double from $20bn today to $40bn by 2025.

Making a “51% attack” practically impossible

The distributed nature of the blockchain requires that no single entity has “control” of the network to insert a malicious block (i.e., 51% attack). With a PoW mechanism, hackers would need to control 51% of the network’s computational power, something that happened numerous times in recent years. With PoS, hackers would need to own 51% of all the cryptocurrency, a more expensive and riskier endeavor.

- In May 2018, Bitcoin Gold (a spinoff of the original Bitcoin) was hacked with $18mn in losses. The same fate awaited Bitcoin SV in August 2019, with value falling by 5%.

Proof-Of-Work Mechanism

A Burgeoning Cryptomining Landscape

Bitcoin hash rates are increasing exponentially

Competition to mine blocks is fierce, pushing the hash rate (the computing power needed to mine and process transactions) to new highs.

- Hash rate measures how fast a mining machine completes computations.

- The higher it is, the higher the likelihood of mining a block and get a reward.

- Thirteen years after the first Bitcoin block was mined (January 2009) with a global hash rate of 5*10–11 EH/s, the world now counts over 1mn miners with a hash rate on a trajectory to reach ~325 EH/s by the end of this year.

The backbone of the crypto ecosystem

Miners will always remain important especially given the speed at which the number of digital assets grows. Moreover, the larger the number of miners, the smaller the chance of a successful hack.

- The only caveat is that finding a miner that will keep up with the growing global mining rate of Bitcoin and remain profitable is like finding a needle in a haystack.

- If the consensus is modified from PoW to PoS, miners with the highest «capital» of specific digital assets shall become the leading validators for that asset.

Handpicking the winners

Among various solutions to get exposed to Bitcoin, we believe miners are well-positioned to capture its price increase. Like conventional miners, their price behaves like a levered exposition to the underlying “mined” asset.

- Only a fraction of all miners hold most of the computing power that validates the transactions on the network.

- NBER found that the top 10% of miners control 90% of the Bitcoin mining capacity, and just 0.005% (about 50 miners) control 50% of the mining capacity.

- The 10 miners we selected should control ~36% of the global capacity in 2022.

A Burgeoning Cryptomining Landscape – Lets Get Financial

To Love Bitcoin And The Environment

Getting the elephant out of the room

One of the main criticisms of mining cryptocurrencies is the amount of energy it consumes. This myth is quickly busted if crypto mining is put in proper perspective.

- Cambridge Bitcoin Electricity Consumption index makes BTC mining accountable for only 0.6% of the world’s total electricity consumption.

- Of ~167K TWh of energy produced annually, >60% is lost in generation, delivery, transmission, and wirings. BTC mining consumes <0.13% of this wasted energy.

Rebuilding a reputation

It is well-known that cryptominers have a dreadful reputation. Their carbon footprint is considered unacceptable. However, it is the industry with the highest proportion of renewable sources and is >90% carbon neutral.

- Annually, miners are responsible for ~40mn tons of CO2, equivalent to ~9mn cars.

- All new and old publicly listed miners put sustainability above potential hash rates.

A never-ending quest for cheap and renewable energy

Miners are known for being extremely flexible and mobile to move around the world in search of affordable, renewable, or even “stranded” energy assets. The latter are the sources that other industries cannot use, e.g., volcanic and geothermal sources, gas flaring recovery (GFR), excess hydro energy after rain.

- Today, natural gas (a by-product of oil extraction) is often burnt or “flared”. GFR could transform these disregarded 688 TWh to power 5x the mining network.

- El Salvador, accepting BTC as a legal tender, has planned to offer 100% clean, renewable, and cheap energy sourced from its geothermal energy plants that use volcanic heat.

Catalysts

- BTC = $1mn. Since all mined Bitcoins are miners’ revenues, everything above a breakeven cost per BTC goes to net profit. Should BTC price triple or eventually reach a 6-figure price for 1 BTC, miners’ profits will grow exponentially.

- New digital assets applications. New use-cases supported by both the retail and institutional world would mean that miners must play an even more critical role in validating and supporting the burgeoning ecosystem, e.g., treasury or daily life.

- Use of 100% renewable energy. By solving sustainability concerns for crypto mining, everyone will be more open to considering blockchain technology for daily use, e.g., Tesla won’t accept crypto as payment until miners switch to at least 50% renewable power.

Risks

- Bans. China’s recent crypto mining ban forced miners to move all their operations away from Chinese renewable hydro energy to U.S. fossil fuels. Similar bans may have unintended consequences for the entire ecosystem.

- Hacking. While compromising the blockchain network is challenging, it remains theoretically possible (need for 51% control). Any security threat and grand-scale hack would deliver an unforgiving reputational blow to the blockchain.

- Shortage of chips. To remain profitable, miners must constantly upgrade their mining fleet. A lack of specialized mining chips would cripple the upgrade cycle, hurt margins, and put mining profitability on its knees.

Source:

Atonra Partners, Company Reports, Nichanank, NBER, Internal Cryptomining Model, Bitcoin Electricity Consumptionndex, Enerdynamics

Companies mentioned in this article:

Argo Blockchain (ARB LN), Bit Digital Inc (BTBT US), BIT Mining (BTCM US), BitFarms (BITF US), BitNile Holdings (NILE US), Cipher Mining (CIFR US), CleanSpark (CLSK US), Core Scientific (CORZ US), CryptoStar (CSTR US), Greenidge Generation Holding (GREE US), Hive Blockchain Technologies Ltd (HIVE US), Hut 8 Mining Corp (HUT CN), Iris Energy (IREN US), Marathon Digital Holding (MARA US), Mawson Infrastructure (MIGI US), Northern Data (NB2 GR), Riot Blockchain Inc (RIOT US), Skychain Technologies (SCT CN), Stronghold Digital Mining (SDIG US), TeraWulf (WULF US)

Atonra’s Ressources And Further Reading

General

Getting rid of middlemen in finance (March 2021)

2020, a pivot year for blockchain in finance (August 2020)

Digital assets

NFTs: the emergence of a new asset class? (December 2021)

Ethereum 2.0: A paradigm shift (September 2021)

Are cryptocurrencies the next internet? (February 2021)

Are cryptos becoming currencies? (September 2020)\

Miners

Finding a needle in a cryptostack (December 2021)

Digital mine, real money (April 2021)

Decentralized Finance

Flashloans (July 2021)

Decentralized finance, system revolution or craze? (October 2020)

Stablecoins & Central Bank Digital Currencies

As Diem goes for the spotlight again, the winner is in the backstage (May 2021)

E-Yuan: China stepping into the future (April 2021)

Libra changes dress (April 2020)

Covid-19 does not slow down the testing of the Chinese digital currency (April 2020)

Kill cash, vol.1 – A Libra sequel (November 2019)

Libra (un)chained (October 2019)

Libra… And now what for fintech and mobile payments? (July 2019)

Exchanges & Financial Services

Year’s Favorites 2022: Silvergate (January 2022)

Robinhood IPO? Better watch it from a distance! (July 2021)

Product Characteristics

Explore:

Disclaimer

This report has been produced by the organizational unit responsible for investment research (Research unit) of atonra Partners and sent to you by the company sales representatives.

As an internationally active company, atonra Partners SA may be subject to a number of provisions in drawing up and distributing its investment research documents. These regulations include the Directives on the Independence of Financial Research issued by the Swiss Bankers Association. Although atonra Partners SA believes that the information provided in this document is based on reliable sources, it cannot assume responsibility for the quality, correctness, timeliness or completeness of the information contained in this report.

The information contained in these publications is exclusively intended for a client base consisting of professionals or qualified investors. It is sent to you by way of information and cannot be divulged to a third party without the prior consent of atonra Partners. While all reasonable effort has been made to ensure that the information contained is not untrue or misleading at the time of publication, no representation is made as to its accuracy or completeness and it should not be relied upon as such.

Past performance is not indicative or a guarantee of future results. Investment losses may occur, and investors could lose some or all of their investment. Any indices cited herein are provided only as examples of general market performance and no index is directly comparable to the past or future performance of the Certificate.

It should not be assumed that the Certificate will invest in any specific securities that comprise any index, nor should it be understood to mean that there is a correlation between the Certificate’s returns and any index returns.

Any material provided to you is intended only for discussion purposes and is not intended as an offer or solicitation with respect to the purchase or sale of any security and should not be relied upon by you in evaluating the merits of investing inany securities.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)